WST 4Q 2017 Commentary

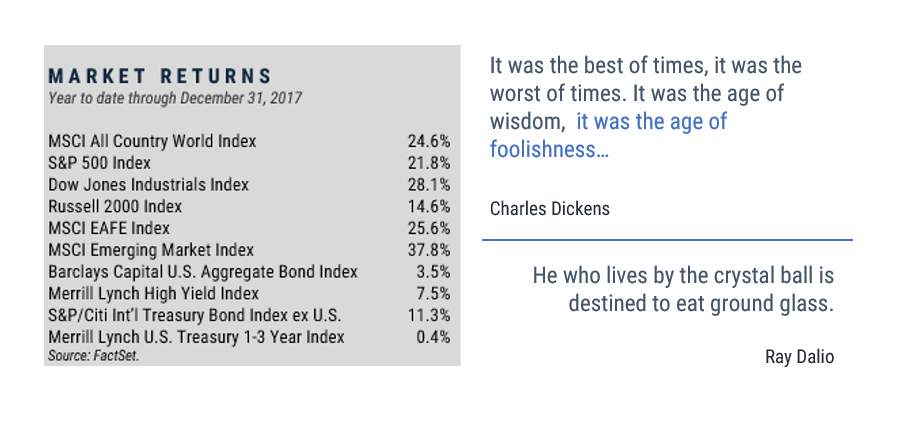

We struggled mightily this quarter to find quotes that capture a moment where economic and market momentum is so strong and risk so underappreciated. The synchronized expansion of the world economy accelerated in the fourth quarter and estimates for 2018 global growth are rising as the details of the U.S. tax bill are factored into economists’ models. Corporate earnings rose almost 20% in 2017, and between permanently lower tax rates and the opportunities presented by the one-time exemption on repatriated cash, companies should enjoy another banner year of profit performance in 2018. Economic fundamentals are healthier than at any point in the current cycle with domestic demand in the U.S. rising, global trade robust, new technologies driving efficiency while unemployment remains low, and the housing, investment and manufacturing sectors all participating. For the first time in a decade, nearly all major developed and emerging economies are in a sweet spot within their cyclical growth cycles, and this strength should continue into 2018. Most estimates project global growth to rise from 3.7% in 2017 to 4.0% in 2018, and as any lingering memories of the carnage wrought by the financial crisis fade expectations are for growth to accelerate in many countries over the next 12-18 months. “It was the best of times….”

Even as the outlook for the global economy remains robust, investors in financial assets need to consider the risk profiles of their portfolios. We are turning the calendar page on an exceptionally strong year of returns for almost all investment asset classes, and it’s worth wondering whether market valuations and the assumptions underlying those valuations are too optimistic even in light of the upbeat outlook.

In a year when the Nobel Prize in economics was awarded to a behavioral economist, we’re reminded of the work of Daniel Kahneman and his book Thinking Fast and Slow. Kahneman points to two human traits that persistently challenge investors: recency bias and optimistic overconfidence. In general, people have a strong tendency to infer that recent trends will continue, and that tendency is particularly strong in investors when recent results have been good. The impulse to see the future as a continuation of the recent past is supported for investors by the analytical community and the press. We have read close to two dozen reports from Wall Street firms and other commentators with forecasts for the economy and markets in 2018, and their crystal balls share a very consistent view: few are predicting more than a remote possibility of a global economic slowdown, and none foresee a major market correction. With expectations so strong market valuations are high, not necessarily in bubble territory, but high enough to support our view that future returns will lag recent performance. An analysis by the investment firm Robeco[1] makes the situation with the S&P 500 index more tangible: over the past six years reported earnings per share have risen by 30% while the index itself has risen four times as much (120%). We acknowledge that they chose this timeframe to maximize the gap, but even so, there is no denying that during this stretch the S&P 500 has outpaced the underlying economy, pushing valuations up.

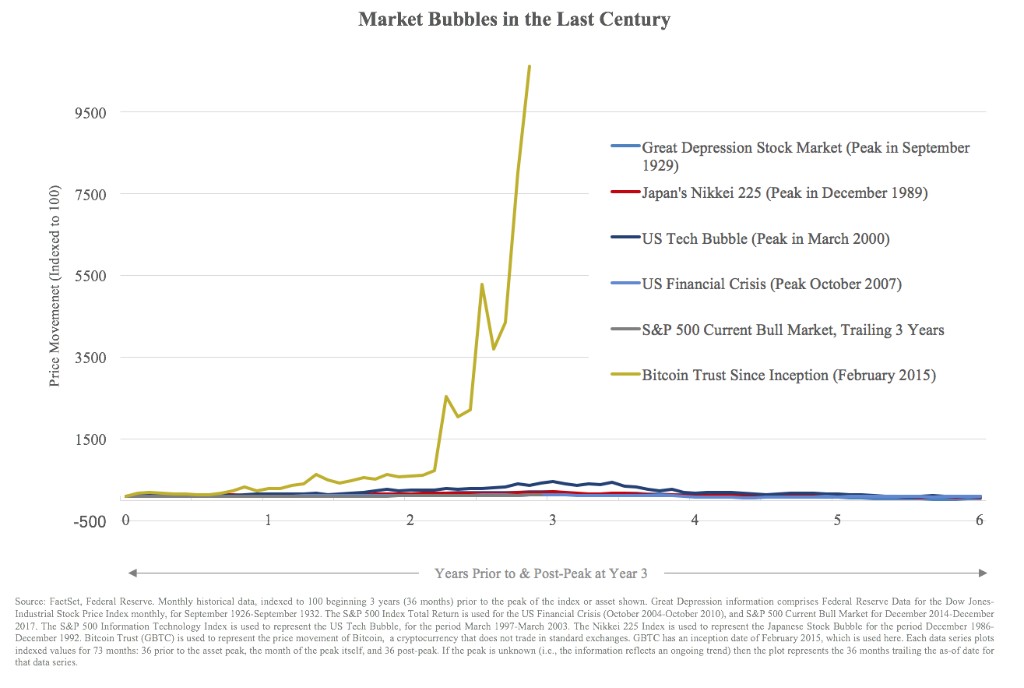

If we were looking for signs of craziness or mania in the realm of investable assets, the fourth quarter gave us a few notable examples. As widely reported, in October a bidder paid $178 million for a Rolex watch once owned by Paul Newman, setting a record price for a watch sold at auction. A month later, in mid-November, Leonardo da Vinci's painting Salvatore Mundi sold for $450 million, setting a new record price for a work of art sold at auction. Finally, in what may turn out to be the greatest bubble since tulip bulbs in Holland in the 1600’s, the price for a unit of Bitcoin reached $19,783 in late December, per the Wall Street Journal. The rise in the price of Bitcoin has dwarfed the other financial bubbles of the last hundred years by such a margin that they look like flat lines in comparison. We are working on a white paper on Bitcoin, so will keep our comments short in this letter. Our summary view is that it is far too early to judge the long-term investment merits of Bitcoin, but there is no doubt that the rise in its price last year reflected a willingness on the parts of investors to suspend disbelief and buy it simply because it was rising. As we write this letter the price of a unit of Bitcoin is $10,050, almost 50% below its December high. “It was the age of foolishness….”

To be clear we are not complaining about the strong markets nor are we predicting an economic downturn or market crash; if we thought either of those events were foreseeable we would shift our allocations and model portfolios to much more conservative positions. The objective of our (hopefully healthy) skepticism on the continually bullish predictions about the global economy and investment markets is to force ourselves to think in terms of the ongoing risk/return trade-off that the stock and bond markets provide, and more importantly how that trade-off should be reflected in the allocation of each client’s portfolio. The strongest returns usually occur during the last stages of an economic expansion, and the market action during the first two weeks of January suggest that the bull market may still have legs. The S&P 500 is off to its fastest start since 1987 as we write this letter. However, with sentiment so strong any additional gains from this point will depend upon perfect earnings performance and sustained high market valuations. We think most of the good news is reflected in current asset prices, so the moment calls for patience and a bias toward conservatism. Our portfolios reflect that view.

Economic Overview

The global economy will face a delicate balancing act this year despite its strong momentum. As one economist put it when describing the economic cycle, this may be the seventh inning stretch or it may be the bottom of the ninth, but we are indisputably late in the game. The impending end of global central banks’ expansive monetary policies carries with it important risks and uncertainty. Higher policy rates and the end of quantitative easing mean the reversal of 10 years of central bank intervention and stimulative policy, a grand experiment which rescued the global economy from the brink of the abyss during the financial crisis and provided the fuel for the long, steady recovery and expansion we are enjoying now. The Federal Reserve is already reducing its inventory of bonds and will accelerate the process this year. The European Central Bank has slowed the asset purchases under its quantitative easing program and will end them all together in 2018. As UBS Chairman Axel Weber pointed out in the Financial Times, the transmission mechanism of quantitative easing is not fully understood and remains controversial, so the impact of tapering, ending, and reversing the process is a big unknown and an important risk to the outlook in 2018.[1]

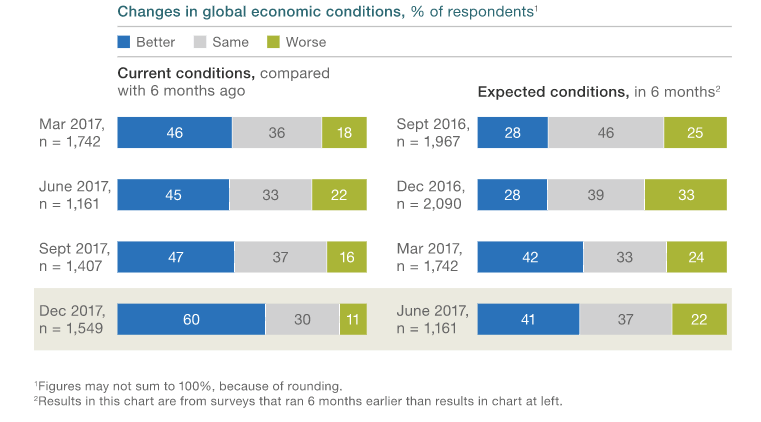

The good news is that by reducing monetary stimulus central bankers are confirming their confidence that the economic expansion is sustainable. McKinsey & Company’s respected global survey of corporate executives supports that confidence. After expressing increasingly positive views on the economy throughout 2017, respondents to McKinsey’s newest survey on economic conditions ended the year on “an exceptionally cheerful note.” According to the report “most respondents say that both global and domestic conditions have improved in recent months, and for the months ahead they are two to three times more likely to believe that conditions will improve than they are to expect declines. Majorities of respondents predict economic growth, worldwide and at home, in the coming months, and expect that trade will rise between their own countries and the rest of the world. Expectations for companies’ growth and demand also have reached new heights.” The chart below demonstrates that in December the McKinsey survey respondents were the most upbeat on the global economy that they had been all year, and their expectations continue to rise.[2]

Source: McKinsey & Company.

Sentiment in the U.S. is supported by the promise that the headwind of tighter monetary policy will be offset at least partially by stimulative fiscal policy. That assumption remains a subject of debate. In a report released in late November[1], the bipartisan Congressional Joint Committee on Taxation estimates that the “Tax Cut and Jobs Act,” which President Trump signed into law on December 22, will increase GDP by just 0.8% over the next 10 years, and rising deficits could offset any potential gains if growth slows. Corporations will enjoy a slew of benefits, most importantly a cut in the federal corporate tax rate from the current 35% to 21%, and J.P. Morgan estimates that S&P 500 earnings will see a $10 per share increase due to the new law, a boost of almost 7%. The extent to which the profit impact of the lower corporate tax rate benefits the overall economy will largely be determined by how companies spend the savings. If businesses opt for capital investments in new plants and equipment or expand their workforces and raise wages, then the law will have a strong stimulative effect. Early indications suggest that companies plan to share at least part of their tax savings with employees. Cash bonuses, higher hourly wages, and larger matching contributions for 401(k) plans are the most popular ways that employers have chosen to spread the wealth. If, on the other hand, companies choose to pay down debt or continue the recent trends of dividend increases and stock buybacks, then stock prices could see a short-term boost but the long-term impact on the economy will be less significant.

Equity Market Overview

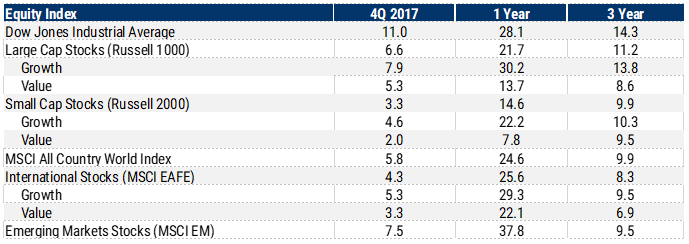

Investors in global stocks enjoyed their best year since the financial crisis last year, and equities finished on a high note in the fourth quarter. The MSCI All-Country Index posted a 5.8% gain for the quarter bringing its total return for the year including dividends to 24.6%. Markets saw double-digit returns across almost all geographies and sectors. Emerging market equities won the blue ribbon with a 7.5% return for the quarter and a 37.8% gain for the year. Europe was the weakest geography in 2017 but the STOXX Europe 600 index still turned in a respectable 7.7% return. Large-cap stocks continued to outperform small companies and growth continued to beat value as big, growth-oriented companies leveraged the improving economy to drive earnings growth. Technology stocks dominated the headlines but companies in most sectors enjoyed increasing efficiency along with solid revenue growth.

Source: FactSet, as of December 31, 2017. Growth and Value are represented by style indices derived from the listed index.

The markets’ big gains last year were a big surprise to most forecasters. Stocks shot up between the November Presidential election and the end of 2016, and virtually no one foresaw the convergence of synchronized global growth, continued low interest rates, and the rapid improvement in Europe and the emerging markets. Until last year the U.S. had led the global economic recovery and confidence soared as the expansion spread around the world, particularly in the emerging markets. As we outlined last quarter, the biggest surprise of 2017 was the lack of surprises. The maximum drawdown in the S&P 500 over the course of the year was 3%, matching the lowest volatility in the past 38 years. That is an amazing statistic given that the high expectations for legislative and regulatory reform a year ago were met by incessant wrangling and gridlock in Washington. The markets might also have been spooked by geopolitical threats in North Korea and the cyber-attack on Equifax among others. Investors’ willingness to overlook those items underscores their confidence in the economic fundamentals.

Back to Kahneman’s concepts of recency bias and optimistic overconfidence, a survey in early 2018 by the American Association of Individual Investors shows that 60% of investors are bullish on the stock market now versus only 15% bearish. In December those numbers were 37% versus 34%. As the Financial Times points out this survey is a great contrary indicator; bears outnumbered bulls by the greatest margin ever the week before the current rally began in March 2009, and the recent survey is the most bullish since then.[1]

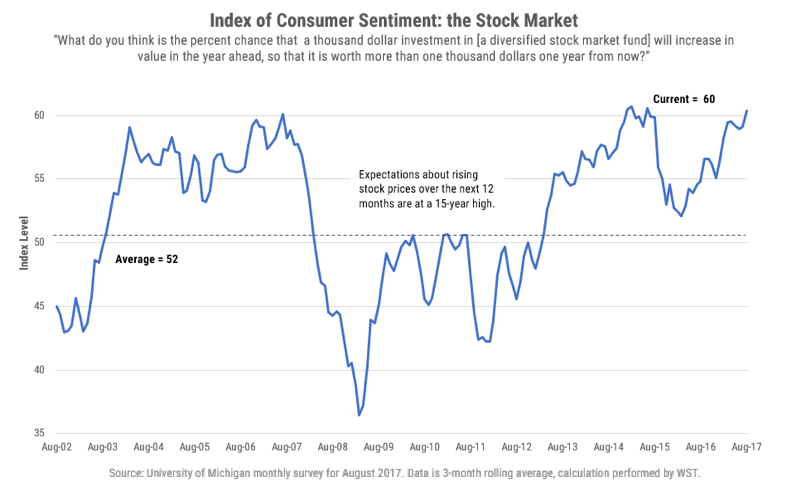

The data graphed below from a University of Michigan sentiment survey tell the same story. Investor sentiment hit a record low when the market bottomed in 2009, which in hindsight was the buying opportunity of a lifetime, and now sentiment is hitting record highs along with the market.

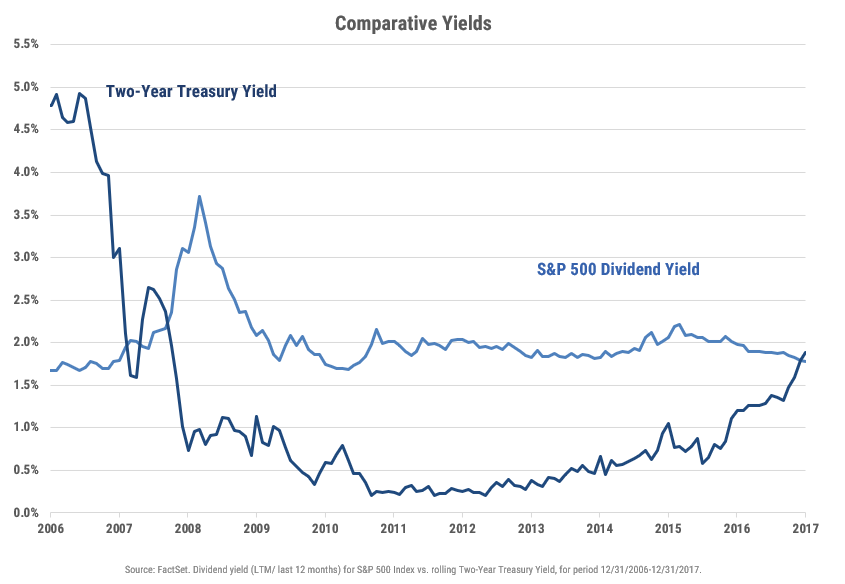

While earnings have been the key driver of equity returns, demand for stocks has also benefited from the “TINA trade” (There Is No Alternative) from investors seeking income. With bond interest rates so low the 2% dividend yield on the S&P 500 has provided a relatively attractive alternative to fixed income; why buy a bond yielding 1.0% to 1.5% when you can own equities paying over 2% in dividends and offering appreciation as the market rises? The low volatility in stocks in recent years seems to have lulled many into complacency and as we will discuss below this complacency may be shaken as interest rates ticked up last quarter and the beginning of 2018. Stock and bond yields just recently crossed a meaningful threshold; for the first time since 2008, the yield on the 2-year Treasury note is higher than the dividend yield of the S&P 500. Suddenly the risk/return trade-off has shifted, and assuming the Fed continues on its stated course of two or three rate hikes in 2018, the 2-year yield will continue to rise, creating real competition for dividend-paying stocks.

Of course, valuations continue to escalate as stock prices rise faster that earnings. Surveyed across most metrics stocks are expensive, and while high valuations don’t predict immediate market declines the negative correlation between current valuation and future returns is strong. Companies in the S&P 500 are now trading at over 23 times their past 12 months of earnings, far higher than their 10-year average of about 17 times earnings, and even using the forward estimate of 2018 earnings the market P/E is over 18. Price/Book Value and Price/Sales ratios for the index both plot at the top of their historical ranges.

Interestingly, the market’s rich valuation doesn’t bother some bulls who contend that the U.S. is at an inflection point where higher corporate earnings are the new normal due to tax and regulatory reform. One CIO pointed out in the Wall Street Journal that “when President Trump signed tax reform on Dec. 22, he effectively increased after-tax earnings for American companies. At a corporate tax rate of 35%, a dollar of earnings turns into 65 cents after Washington takes its cut. At the new 21% rate, the same dollar becomes 79 cents. That’s earnings growth of 21.5% with the stroke of Mr. Trump’s pen.”[1]

Given the strong economic backdrop, high stock prices do not necessarily portend the end of the bull market, but with valuations full and investor complacency high, the margin for error is thin. An unexpected jolt of inflation, a geopolitical event, or some other “black swan” that spooks the market could drive a larger than average correction in asset prices, and we are reviewing portfolios to be sure that each client is positioned correctly in advance of whatever surprises may occur this year. More importantly, we’re integrating our assumption that long term future equity returns will be lower than past ones, particularly in the U.S., into our client portfolios. Valuations outside of the U.S. remain relatively inexpensive despite the outperformance of international stocks last year, so we are maintaining and may increase our weightings in foreign equities as opportunities arise. Emerging markets in particular look attractive as those economies are expected to expand over 5% this year [2] and corporate governance in once “lawless” markets continues to improve.

Bond Market Overview

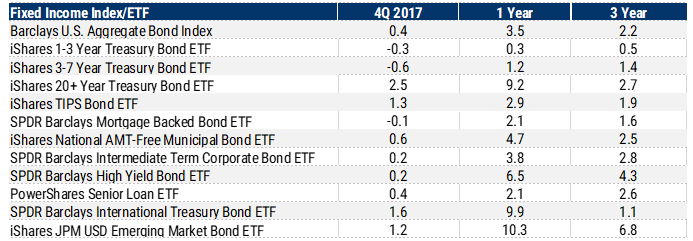

Bond investors shrugged off the strengthening global economy and the transition in central bank policy for most of last year, confounding the vast majority of forecasters who again predicted the end of the 36-year bull market for fixed income. The Barclays U.S. Aggregate Bond Index generated a total return of 3.5% in 2017, short-term bonds were essentially flat and the 20+ Year Treasury Bond ETF was up over 9%. Short term rates, which are most responsive to the policy of the Federal Reserve, rose in the fourth quarter. The yield curve flattened substantially over the course of the year with the short end driven higher by the three Fed rate hikes and the long end anchored by low inflation. Overall, the two-year Treasury yield was up 69.5 basis points in 2017, with 64.5 basis points of that move occurring in the last four months of the year. The 10-year Treasury yield was up just 2.5 basis points while the thirty-year yield closed down 32.5 basis points on the year.

Source: FactSet, as of December 31, 2017. Inclusion of securities utilized to represent the performance of market segments is not a recommendation.

The tide has begun to shift in early 2018. The second week of the year saw government bonds around the world sell off as fixed income investors began to focus on the fact that 2018 will be the first year in a decade where central banks will, on a net basis, be withdrawing money from the markets. Recent data indicates that the Bank of Japan's purchases of long-term bonds have slowed and rumors have begun to circulate that China is considering reducing its ownership of U.S. Treasuries. With issuance of government debt expected to rise in 2018 the markets may have to absorb $600 billion of bonds this year, a swing in the supply/demand picture versus 2017 when the central banks of the U.S., Europe, Japan and the UK bought $170 billion more government bonds than were issued.[1]

As it stands, the fixed income markets offer very little upside and lots of risk, particularly in long-duration bonds. The flat yield curve means that investors receive meager compensation for extending the maturity of their portfolio, and while long maturity bonds outperformed in 2017 those gains will disappear quickly if rates rise even marginally.

Economic growth is the fundamental driver of the bond market just as it is for the equity market, but where stronger growth is bullish for stocks the inflationary forces that typically arise late in the economic cycle are bearish for bonds. So far inflation remains subdued as cheap commodities, shifting demographics, high savings rates, and technology advances have offset low unemployment and strong consumer demand. However, as 2018 progresses the bond market will be tested by new trends. Global growth could put pressure on commodity prices and the tight labor market could finally drive wages up, forcing the Fed into tightening sooner and more than the market expects. Any uptick in inflation will drive longer term yields higher, and long duration bonds are most price sensitive to higher yields.

Still, our relatively short duration, defensive portfolio positioning in fixed income portfolios is driven less by fear of a major spike in rates than by the lack of opportunity in long term securities. Conditions are ripe for the long-anticipated reversal of the multi-decade bull market in bonds, and with both credit and duration spreads low, fiscal stimulus under way in the U.S., and tighter monetary policies evolving around the world, we don’t think investors are adequately rewarded for taking additional risk.

Summary

In summary, the outlook for global growth remains encouraging. Participation across geographies is broad with 94% of countries in the world experiencing positive year-over-year GDP growth last year and 61% of those economies accelerating late in the year, according to Goldman Sachs.[1] As 2018 progresses, the dominant factor driving the markets will be the world economy's ability to meet the expectations set by last year’s broad, deep, and strong expansion. Closely linked to economic growth are corporate earnings, and tying it all together will be the path taken by the Federal Reserve and other central banks. If inflation and interest rates rise more quickly than expected, the punch bowl of monetary liquidity will be empty, and the party may come to an end. On the other hand, if companies and families strike the right balance between investing and consuming their tax savings, and if the Fed remains supportive and inflation remains in check, then these halcyon days of economic and market growth can continue. All things considered we see a strong rationale for risk management, and we remain patiently invested in the mix of assets that we think strikes the right balance of capital preservation and growth for each individual client.

As always we remain grateful for the opportunity to work with you, and we look forward to a visit or conversation in the near future.

Wayne F. Wilbanks, CFA

Lawrence A. Bernert III, CFA

D.J. Kyle Elliott, CFP

Mark R. Warden

Roger H. Scheffel Jr., CPA, PFS

Thomas F. X. McNally, CMT, CFA

Wade A. Monroe, CIMA

Paul A. Ferwerda, CFA

Dan F. Powell, CFA, AIF

Unless otherwise indicated, performance information for indices, funds and securities is sourced from FactSet as of September 30, 2017. This newsletter represents opinions of Wilbanks, Smith and Thomas Asset Management, LLC that are subject to change and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. The information contained herein has been obtained from sources believed to be reliable, but cannot be guaranteed for accuracy. Some portions of this letter were written in conjunction and collaboration with Capital Markets Consultants Inc. This material is proprietary and being provided on a confidential basis, and may not be reproduced, transferred or distributed in any form without prior written permission from WST. WST reserves the right at any time and without notice to change, amend, or cease publication of the information. This material has been prepared solely for informative purposes. It is made available on an "as-is" basis without warranty. There are no guarantees investment objectives will be met.

This newsletter represents opinions of Wilbanks, Smith and Thomas Asset Management, LLC and are subject to change from time to time, and do not constitute a recommendation to purchase or sell any security nor to engage in any particular investment strategy. This material is proprietary and being provided on a confidential basis, and may not be reproduced, transferred or distributed in any form without prior written permission from WST. WST reserves the right at any time and without notice to change, amend, or cease publication of the information. This material has been prepared solely for informative purposes. The information contained herein includes information that has been obtained from third party sources and has not been independently verified. It is made available on an "as is" basis without warranty. There are no guarantees investment objectives will be met.

The information contained herein has been obtained from sources believed to be reliable, but cannot be guaranteed for accuracy.

Market indices are unmanaged and do not reflect the deduction of fees or expenses. You cannot invest directly in an index such as these and the performance of an index does not represent the performance of any specific investment strategy. We consider an index to be a portfolio of securities whose composition and proportions are derived from a rules based model. Market indices are unmanaged and do not reflect the deduction of fees or expenses. You cannot invest directly in an index such as these and the performance of an index does not represent the performance of any specific investment strategy.

The S&P 500 Index is a market capitalization weighted index, including reinvestment of dividends and capital gains distributions that is generally considered representative of U.S. stock market. The Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange (NYSE) and the NASDAQ. The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI ex USA Index is designed to provide a broad measure of stock performance throughout the world, with the exception of U.S.-based companies. The MSCI EAFE Index is a stock market index that is designed to measure the equity market performance of developed markets outside of the U.S. & Canada. It is maintained by MSCI Barra, a provider of investment decision support tools; the EAFE acronym stands for Europe, Australasia and Far East. The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets (EM) countries. With 845 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. The Russell 2000 index measures the performance of the 2,000 smallest companies in the Russell 3000 index. The Bloomberg Barclays U.S. Aggregate Bond Index covers the USD-denominated, investment-grade, fixed-rate, taxable bond market of SEC-registered securities. The index includes bonds from the Treasury, Government-Related, Corporate, MBS, ABS, and CMBS sectors. The BofA Merrill Lynch U.S. High Yield Index tracks the performance of U.S. dollar denominated below investment grade corporate debt publicly issued in the U.S. domestic market. Qualifying securities must have a below investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $250 million. The BofA Merrill Lynch 1-3 US Year Treasury Index is an unmanaged index that tracks the performance of the direct sovereign debt of the U.S. Government having a maturity of at least one year and less than three years. The S&P/Citigroup International Treasury Bond ex-U.S. Index measures the performance of treasury bonds, with maturities greater than or equal to one year, issued by non-U.S. developed market countries.

[1] Goldman Sachs Asset Management, Market Pulse Special Edition “10 For 2018”

[1] Wigglesworth, Robin “Fear of Normality” Financial Times, January 13, 2018.

[1] Luskin, Donald “Tax Reform Has Released the Bulls.” Wall Street Journal, January 11, 2018.

[2] The World Bank “Broad Based Upturn – But For How Long?” Global Economic Prospects, January 2018.

[1] Authers, John “Signs Of Euphoria Suggest Equity Bulls Are On Borrowed Time.” Financial Times, January 5, 2018.

[1] Macroeconomic Analysis Of The "Tax Cut And Jobs Act" As Ordered Reported By The Senate Committee On Finance On November 16, 2017. Retrieved from https://www.jct.gov/publications.html?func=startdown&id=5045.

[1] Weber, Axel, “Markets Must Prepare For More Volatility,” Financial Times, January 3, 2018.

[2] Smit, Sven, Economic Conditions Snapshot, December 2017: McKinsey Global Survey Results.

[1] Playing In Extra Time” – Robeco Investment Outlook 2018

Besides attributed information, this material is proprietary and may not be reproduced, transferred or distributed in any form without prior written permission from WST. WST reserves the right at any time and without notice to change, amend, or cease publication of the information. This material has been prepared solely for informative purposes. The information contained herein may include information that has been obtained from third party sources and has not been independently verified. It is made available on an “as is” basis without warranty. This document is intended for clients for informational purposes only and should not be otherwise disseminated to other third parties. Past performance or results should not be taken as an indication or guarantee of future performance or results, and no representation or warranty, express or implied is made regarding future performance or results. This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security, future or other financial instrument or product.