3Q 2021: Economic & Markets Overview

Read More

Clearstead Advisors Announces Acquisition of Wilbanks Smith and Thomas

Posted on April 1, 2024

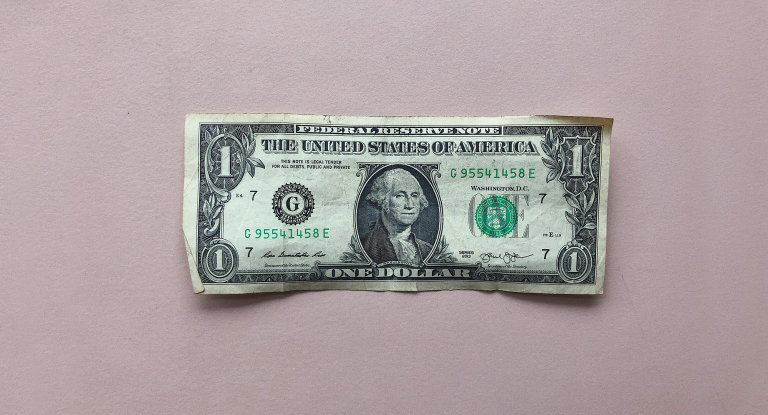

NORFOLK, VA, April 01, 2024 — Clearstead Advisors, LLC, a leading registered financial advisor (“RIA”), has acquired the assets of Wilbanks Smith and Thomas Asset Management, LLC (“WST”), a Norfolk, Virginia based wealth and investment management firm with over $5 billion of assets under management. The combination continues Clearstead’s rapid

January 2024 | Global Equity Markets Review

Posted on February 12, 2024

The S&P 500 Index registered its third consecutive monthly gain in January with a return of 1.68%.

January 2024 | Fixed Income Markets Review

Posted on February 12, 2024

Fixed income markets faced mixed returns in January following the strong performance to end 2023. Shifts in the yield curve level and slope were minimal as interest rate volatility declined over the period.

December 2023 | Global Equity Markets Review

Posted on January 19, 2024

December continued the previous month's rally in stocks, finishing just one day shy of the annual peak and less than 1% below the all-time high reached in January 2022.

December 2023 | Fixed Income Markets Review

Posted on January 19, 2024

Fixed income markets rallied again in December following the robust performance in the previous month.

4Q 2023 | Economic & Markets Review

Posted on January 11, 2024

The markets experienced robust economic growth in 2023 characterized by low unemployment and a formidable 2.8% real GDP expansion, leading to a widely anticipated soft landing. Nevertheless, concerns surfaced as market expectations for more pronounced interest rate cuts exceeded the Federal Reserve's official guidance. Read more from our quarterly commentary here.

November 2023 | Global Equity Markets Review

Posted on December 8, 2023

In November, the U.S. equity market had its best month of the year, marked by a 9.13% increase in the S&P 500 Index.

November 2023 | Fixed Income Markets Review

Posted on December 8, 2023

Markets rebounded amid lower Treasury yields and strong bond performance in November.

October 2023 | Global Equity Markets Review

Posted on November 9, 2023

In October, negative fixed income performance was driven by rising intermediate- and long-term yields, with the 10-year Treasury peaking above 5% before settling at 4.90%.

October 2023 | Fixed Income Markets Review

Posted on November 9, 2023

In October, negative fixed income performance resulted from rising intermediate- and long-term yields.

September 2023 | Fixed Income Markets Review

Posted on October 18, 2023

Fixed income assets declined in September, with the Bloomberg US Aggregate Bond Index falling -2.54% for the month.

September 2023 | Global Equity Markets Review

Posted on October 18, 2023

Markets declined for the second consecutive month in September.

3Q 2023 | Economic & Markets Review

Posted on October 11, 2023

The investment landscape shifted in the third quarter of 2023. Our quarterly letter discusses this shift in greater detail.

August 2023 | Fixed Income Markets Review

Posted on September 13, 2023

In August, fixed income assets saw predominantly negative returns, notably with the Bloomberg Barclays US Aggregate Bond Index posting a -0.64% return. Shorter-duration bonds emerged as top performers during this period, led by floating rate notes, short-term Treasuries, and leveraged loans, while underperformers included emerging markets debt, municipals, and long-term Treasuries.

August 2023 | Global Equity Markets Review

Posted on September 13, 2023

In August, the financial markets experienced a downturn — following robust performance in the preceding two months of June and July — although the stock market rebounded by 3.2% from its mid-month low, partially mitigating the overall losses during the month.

Wilbanks Smith & Thomas Recognized as a Top Financial Advisor by CNBC

Posted on September 13, 2023

Wilbanks Smith & Thomas is pleased to announce it has been recognized in CNBC's highly anticipated FA 100 ranking for 2023.

Lawrence Bernert, III Named to Virginia 500 Power List

Posted on September 1, 2023

Wilbanks Smith & Thomas is pleased to announce that Principal and Portfolio Manager, Lawrence Bernert, III has been named to the prestigious Virginia 500 Power List for the second consecutive year.

July 2023 | Global Equity Markets Review

Posted on August 16, 2023

Global equities rallied in July with all eleven of the major economic sectors rising during the month.

Selling Your Business | 7 Strategies for Minimizing Taxes

Posted on August 15, 2023

While every business owner's circumstances are unique, there are several common estate planning strategies that can reduce the tax implications of asset transfers, potentially saving millions of dollars. This additional part to our guide to Selling Your Business uncovers 7 strategies in accomplishing this.

Selling Your Business | A Comprehensive Guide

Posted on August 15, 2023

Selling a business is undoubtedly one of the most significant financial decisions in one's life. If you're navigating this process for the first time, it's natural to have many questions. This 2-part guide helps answer some of those questions.

July 2023 | Fixed Income Markets Review

Posted on August 14, 2023

Rising short- and long-term yields along the Treasury curve resulted in mixed results for fixed income assets in July.

Wilbanks Smith & Thomas Recognized as a Top 100 Firm by FA Magazine in the 2023 RIA Survey and Rankings List

Posted on August 2, 2023

Wilbanks Smith & Thomas Asset Management, LLC, a leading wealth management firm headquartered in Norfolk, Virginia, is pleased to announce that it has been recognized by FA Magazine as a Top 100 RIA.

June 2023 | Global Equity Markets Review

Posted on July 14, 2023

Equity markets surged ahead in June as the S&P 500 finished the period at the highest level in 14 months.

June 2023 | Fixed Income Markets Review

Posted on July 14, 2023

Fixed income assets suffered mixed results amid pronounced yield increases to shorter maturities along the US Treasury curve.

2Q 2023 | Economic & Markets Review

Posted on July 12, 2023

The evolving macroeconomic picture gave investors plenty to think about during the second quarter. Read our Quarterly Commentary here.

May 2023 | Global Equity Markets Review

Posted on June 9, 2023

Unusual market patterns continued in May. The S&P 500 Index total return was +0.43%, while the S&P Mid Cap 400 and S&P 600 Small Cap returned -3.19% and -1.75%, respectively.

May 2023 | Fixed Income Markets Review

Posted on June 9, 2023

Fixed income assets declined in May amid increasing yields along the Treasury curve, weighing on asset class performance.

April 2023 | Global Equity Markets Review

Posted on May 10, 2023

The disparity in market returns witnessed last month continued in April.

April 2023 | Fixed Income Markets Review

Posted on May 10, 2023

Fixed income assets experienced modest gains in April as markets rebounded following the volatility in the prior month.

To Raise or Not to Raise: The History & Impact of the Federal Debt Ceiling

Posted on May 8, 2023

This year's headlines have given rise to several short-term concerns for investors, including the ongoing debate about the federal debt ceiling. Here's what you need to know.

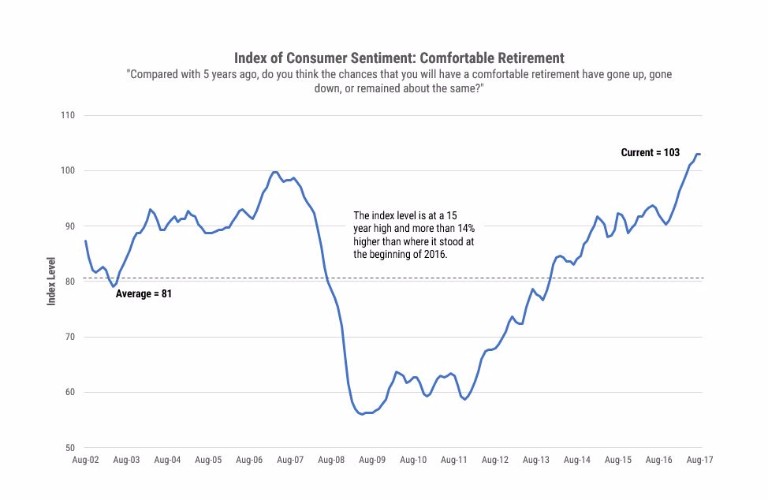

Virginia Ranked "Best State to Retire"

Posted on May 3, 2023

WalletHub's recent study, "2023's Best States to Retire," has ranked Virginia as the best state to retire. The study evaluated all 50 U.S. states based on three major categories: affordability, quality of life, and access to healthcare.

March 2023 | Fixed Income Markets Review

Posted on April 13, 2023

Fixed income markets rallied in March amid the liquidity crisis facing US banks and the subsequent emergency measures from the Fed and Treasury Department.

March 2023 | Global Equity Markets Review

Posted on April 13, 2023

Turmoil in the banking sector in March produced a vast disparity of returns.

1Q 2023 | Economic & Markets Commentary

Posted on April 12, 2023

Global equity markets rallied in the first quarter, supported by investor expectations for a monetary policy shift from the Federal Reserve. Fixed income assets experienced rising interest rate volatility as yields fell in March following their rise in the prior two months. The recent banking sector crisis seems to be averted as measures from policymakers have provided ample liquidity to US institutions.

February 2023 | Fixed Income Markets Review

Posted on March 10, 2023

Fixed income markets faced headwinds during the month as rising yields along the Treasury curve weighed on asset class performance.

February 2023 | Global Equity Markets Review

Posted on March 8, 2023

Equity markets paused in February after a strong start to the year.

WST Capital Management Named Top Guns Manager for Fourth Consecutive Quarter

Posted on February 21, 2023

WST Capital Management, the ETF strategy division of Wilbanks Smith & Thomas offering a platform of risk-managed, model-based asset class investment solutions, has been named to the celebrated PSN Top Guns List

SECURE Act 2.0 | Updates & Implications

Posted on February 16, 2023

The SECURE Act 2.0 of 2022 is a follow-up to the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019 in an effort to help Americans save and prepare for a financially secure retirement.

January 2023 | Fixed Income Markets Review

Posted on February 10, 2023

Fixed income assets moved higher in January amid declining interest rate volatility and falling intermediate- and long-term yields.

January 2023 | Global Equity Markets Review

Posted on February 10, 2023

Global equities rallied to begin 2023 as international and SMID cap stocks were among market leaders.

December 2022 | Global Equity Markets Review

Posted on January 18, 2023

Global equity markets suffered declines in December amid the challenges facing investors in 2023.

December 2022 | Fixed Income Markets Review

Posted on January 12, 2023

Fixed income assets faced mixed results in December as rising yields weighed on asset class performance.

4Q 2022 | Markets & Economic Review

Posted on January 6, 2023

Global equity markets rallied in the fourth quarter buoyed by investor speculation on the Fed’s slowdown of quantitative tightening. Fixed income finished the period largely positive amid investors navigating the most challenging year for bonds in decades. Read more here.

November 2022 | Fixed Income Markets Review

Posted on December 12, 2022

Fixed income assets moved higher during the month supported by declining intermediate- and long-term yields along the Treasury curve.

November 2022 | Global Equity Markets Review

Posted on December 12, 2022

Global equities rallied in November while volatility eased and markets price in a 50 bps rate hike at the next FOMC meeting.

Informa Investment Solutions Names WST Capital Management Top Guns Manager for Third Consecutive Quarter

Posted on November 21, 2022

WST Capital Management named Top Guns Manager for Credit Select Risk-Managed strategy.

October 2022 | Global Equity Markets Review

Posted on November 14, 2022

After setting a new low for 2022, global equities subsequently rebounded in the days leading up to month end.

October 2022 | Fixed Income Markets Review

Posted on November 14, 2022

Fixed income assets faced mixed results in October as interest rate volatility surged to new highs.

September 2022 | Global Equity Markets Review

Posted on October 21, 2022

Equity market weakness that began in mid-August carried forward into September and pushed the market down to a new low for 2022.

September 2022 | Fixed Income Markets Review

Posted on October 21, 2022

Fixed income investors experienced equity-like volatility during 2022 and September offered no relief from rising rates pushing bond prices lower.

3Q 2022 | Markets & Economic Overview

Posted on October 7, 2022

The third quarter brought more challenges for investors as markets responded to the turbulent geopolitical picture, stubbornly high inflation, and increasingly hawkish positioning by global central banks.

WST Recognized by CNBC | 2022

Posted on October 4, 2022

CNBC published its 2022 FA 100 rankings on October 4th, naming Wilbanks Smith & Thomas Asset Management, LLC (WST) to the list.

August 2022 | Global Equity Markets Review

Posted on September 12, 2022

Strong employment data and the Fed’s reasserted commitment to combat inflation forced investors to adjust their expectations regarding size and tenure of interest rate hikes, creating downward pressure on global equity markets.

August 2022 | Fixed Income Markets Review

Posted on September 12, 2022

A hawkish message from Jerome Powell during the Federal Reserve’s annual conference at Jackson Hole resulted in Treasury yields rising on both the 2Y and 10Y areas of the yield curve.

WST Principal Named to 2022 Virginia 500 Power List

Posted on August 30, 2022

WST is pleased to announce that Lawrence Bernert III, CFA, Principal at WST, has been named to the 2022 Virginia Business 500 Power List

July 2022 | Global Equity Markets Review

Posted on August 9, 2022

Following the turbulence to begin the year, global equities surged in July as declining interest rates served to bolster the asset class.

July 2022 | Fixed Income Markets Review

Posted on August 9, 2022

Fixed income assets experienced a welcomed rally in July amid intermediate and long-term yields declining along the Treasury curve.

WST Controller Named Finalist for VA Business Annual CFO Awards

Posted on August 3, 2022

Wilbanks Smith & Thomas is pleased to announce that Ana Gomes, CPA has been named a Finalist for VA Business' 17th annual CFO Awards.

2Q 2022 | Markets & Economic Overview

Posted on July 11, 2022

Global equity markers extended their losses in the second quarter as investors continue to confront the headwinds of persistent inflationary pressures and hawkish policy measures from central banks globally. Fixed income assets have given investors little reprieve from the market sell-offs while bonds have experienced their worst start to a calendar year on historical record.

June 2022 | Global Equity Markets Review

Posted on July 8, 2022

Following the gains in the prior month, selling resumed in June resulting in the second weakest month for equities in 2022.

June 2022 | Fixed Income Markets Review

Posted on July 8, 2022

Following the May rebound in global bonds, fixed income assets suffered another agonizing month in June amid surging interest rates and unrelenting inflationary pressures.

May 2022 | Fixed Income Markets Review

Posted on June 8, 2022

Fixed income assets rebounded in May as global aggregate bonds posted their first positive monthly return in 2022.

May 2022 | Global Equity Markets Review

Posted on June 7, 2022

Equity markets managed to squeeze out positive returns for May thanks to a late-month rally.

Informa Investment Solutions Names WST Capital Management Top Guns Manager

Posted on May 20, 2022

WST Capital Management was named a Top Gun with ratings of 2 stars for the period ended 1Q2022 — the current maximum number of stars for the strategy’s category.

April 2022 | Global Equity Markets Overview

Posted on May 9, 2022

Global equity markets continued to fall in April as aggressive Fed tightening, inflationary pressures and the extended conflict in Europe weighed on investor sentiment.

April 2022 | Fixed Income Markets Overview

Posted on May 9, 2022

Fixed income assets suffered losses over the month while U.S. aggregate bonds faced their worst monthly decline since February 1980.

1Q 2022 | Quarterly Economic & Markets Review

Posted on April 14, 2022

We entered 2022 expecting stubbornly strong inflation, higher interest rates, and increased market volatility, and the first quarter delivered on all fronts.

March 2022 | Fixed Income Markets Review

Posted on April 8, 2022

Fixed income assets extended their losses in March as bond investors face continued headwinds around inflationary trends and hawkish policy measures from the Fed.

March 2022 | Global Equity Review

Posted on April 8, 2022

Equity markets initially followed the downward trajectory established in January and February before rallying off the early March lows to register the first monthly positive return during 2022.

February 2022 | Fixed Income Markets

Posted on March 11, 2022

Fixed income investors saw rising interest rate volatility over the month as a lofty inflation print and expected Fed actions drove the flattening along the Treasury yield curve.

February 2022 | Global Equity Markets

Posted on March 11, 2022

Global equity markets suffered losses in February while investors weighed concerns surrounding the Russian invasion of Ukraine and continued inflationary pressures.

January 2022 | Global Equity Markets

Posted on February 11, 2022

Global equity markets experienced losses to start the year as the selloff in stocks occurred across the market capitalization spectrum.

January 2022 | Fixed Income Markets

Posted on February 11, 2022

Fixed income investors saw flattening along the U.S. Treasury yield curve amid the hawkish policy stance by the Federal Reserve.

December 2021 | Fixed Income Markets

Posted on January 20, 2022

Fixed income assets faced varying results in December as investors saw a reversal in the movement of Treasury yields.

December 2021 | Global Equity Markets

Posted on January 20, 2022

December proved itself once again as a consistently positive month of the year.

4Q 2021 | Quarterly Economic & Markets Review

Posted on January 11, 2022

Global equity markets exhibited strong performance during the fourth quarter even as investors faced renew Covid uncertainty, rising inflation and a Fed policy pivot. Amid an uptick in interest rate volatility, fixed income assets saw mixed results over the period as short- and intermediate-term yields rose along the U.S. Treasury yield curve.

October 2021 | Global Equity Markets

Posted on November 9, 2021

Equity markets reached all-time highs in October as robust corporate earnings and progress on COVID-19 drove indices higher.

October 2021 | Fixed Income Markets

Posted on November 9, 2021

Fixed income assets saw mixed results during the month amid rising Treasury yields and increasing bond market volatility.

3Q 2021 | Quarterly Economic & Markets Review

Posted on October 18, 2021

“Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.” -Sam Ewing

“Some say the world will end in fire, Some say in ice….” -Robert Frost

Investment markets proved resilient for most of the third quarter as generally positive economic

September 2021 | Global Equity Markets

Posted on October 11, 2021

Global equities suffered declines in September as the S&P 500 faced the largest drop since March 2020.

September 2021 | Fixed Income Markets

Posted on October 11, 2021

Fixed income markets fell during the month as rising intermediate- and long-term yields resulted in yield curve steepening.

WST Recognized by CNBC | 2021

Posted on October 7, 2021

CNBC published its 2021 FA 100 rankings on October 6th, naming Wilbanks Smith & Thomas Asset Management, LLC (WST) to the list.

WST Now Hiring: Research Associate

Posted on September 17, 2021

WST is seeking to fill the position of Research Associate & Trader which is a full-time permanent position working in our Norfolk, Virginia office.

August 2021 | Global Equity Markets

Posted on September 15, 2021

Global equity markets were propelled higher in August as U.S stocks continued to outperform relative to international equities.

August 2021 | Fixed Income Markets

Posted on September 13, 2021

Fixed income assets faced headwinds during the month as investors saw long-term yields rise on the heels of another above-average inflation print.

Wilbanks Smith & Thomas Named to Inside Business' Top Workplaces List

Posted on August 17, 2021

WST is pleased to announce its naming to Inside Business' list of Top Workplaces of 2021.

July 2021 | Global Equity Market Review

Posted on August 12, 2021

July was another positive month for U.S. equities, with the S&P 500 Index producing a total return of 2.38%. Broader market domestic indices lagged with S&P Mid Cap 400 Index returning just 0.35% and the S&P 600 Small Cap Index falling into negative territory for the month at -2.39%. The

July 2021 | Fixed Income Markets Review

Posted on August 12, 2021

Fixed income returns were generally positive for the month of July as long-term yields fell for the fourth consecutive month. The Bloomberg Barclays U.S. Aggregate finished the month up 1.12%, bringing the year-to-date total return to -0.50%.

Long-term rates continued to trend down throughout the month, with the ten and thirty-year

WST Ranked by FA Magazine | 2021 RIA Report

Posted on July 27, 2021

FA Magazine published its 2021 RIA Survey & Ranking report, naming WST among the largest RIAs ranked in the report.

Q2 2021 | Quarterly Economic & Markets Overview

Posted on July 19, 2021

The global recovery accelerated in the second quarter as COVID-19 retreated and economies around the world reopened, albeit at widely varied rates.

June 2021 | Global Equity Markets Review

Posted on July 14, 2021

Global equity markets saw mixed performance in June as investors witnessed signs of narrowing market breadth and a shift in market leadership back towards large-cap growth stocks.

June 2021 | Fixed Income Markets Review

Posted on July 13, 2021

Long-term yields continued to trend downward during the month as market participants weigh the impacts on future economic growth of the increasing number of Delta variant cases.

May 2021 | Fixed Income Markets Review

Posted on June 11, 2021

Fixed income returns were generally positive for May as long-term U.S. Treasury yields fell for the second straight month.

May 2021 | Global Equity Markets Review

Posted on June 11, 2021

Equity markets continued to rally in May as the reopening trade extended across the globe.

WST Principals Named to Inside Business 2021 Power Lists

Posted on May 19, 2021

WST is pleased to share that Wayne Wilbanks, co-founder and Managing Principal, was named to the Emeritus list and Larry Bernert, Principal, was named to The Next 75 list.

April 2021 | Fixed Income Markets Review

Posted on May 11, 2021

Fixed income returns were mostly positive for the month of April as long-term yields decreased.

April 2021 | Global Equity Markets Review

Posted on May 10, 2021

Equity markets continued their upward trajectory in April although leadership differed markedly from year-to-date patterns.

10th Annual Stone Soup Event | WST & Women United

Posted on April 30, 2021

WST joins Women United for their 10th annual Stone Soup event.

1Q 2021 | Economic & Markets Overview

Posted on April 19, 2021

Although investors have seen improving trends around coronavirus and economic activity as of late, uncertainty still remains throughout capital markets as we emphasize the importance of a globally diversified approach to client portfolios.

March 2021 | Fixed Income Markets Review

Posted on April 13, 2021

Fixed income markets experienced weakness during the month as investors saw yield curve steepening and inflation expectations trend higher.

March 2021 | Global Equity Markets Review

Posted on April 12, 2021

Global equity markets continued to push higher in March as vaccine rollouts progress and $2 trillion in additional fiscal stimulus was passed during the month.

February 2021 | Fixed Income Markets Review

Posted on March 12, 2021

February was another negative month for fixed income markets as increasing inflation expectations continued to push long-term rates higher.

February 2021 | Global Equity Markets Review

Posted on March 12, 2021

After a soft start to the year, the market bounced back strongly in February with all major U.S. indexes posting positive returns.

January 2021 | Fixed Income Markets Review

Posted on February 12, 2021

Fixed income sectors posted negative returns in January while the long end of the yield curve saw rising rates amid increases in inflation expectations.

January 2021 | Global Equity Markets Review

Posted on February 10, 2021

U.S. equity markets were mixed in January of 2021 with the S&P 500 down -1% while mid cap and small cap indices saw flat-to-positive gains.

4Q 2020 Economic & Markets Overview

Posted on January 26, 2021

4Q 2020 brought important transitions in the war against COVID and the global economy and investment markets.

December 2020 | Fixed Income Markets Review

Posted on January 13, 2021

Fixed income markets saw modest gains in 4Q as investors monitor yield curve steepening and increased inflation expectations going forward.

December 2020 | Global Equity Markets Review

Posted on January 7, 2021

World equity markets ended the year on a positive note in December. Investors expressed relief that 2020 concluded and are optimistic about a vaccine for COVID–19 as well as a return to normal economic activity.

November 2020: Fixed Income Markets Review

Posted on December 11, 2020

Market participants saw strong returns in fixed income assets during the month as election angst in the U.S. dissipated and the economic outlook became clearer.

November 2020: Global Equity Markets Review

Posted on December 11, 2020

Global equities experienced robust performance during November as small cap and international stocks were among the top performers.

October 2020: Global Equity Markets Review

Posted on November 11, 2020

Global equity returns were mixed for the month of October as investors braced for the upcoming U.S. presidential election and developments surrounding COVID-19.

October 2020: Fixed Income Markets Review

Posted on November 11, 2020

Fixed Income investors saw negative to modest returns during the month while markets reacted to yield curve steepening and an uptick in inflation expectations.

3Q 2020 Economic & Market Overview

Posted on October 15, 2020

Investors saw strong performance in both global equity and fixed income markets during the third quarter of 2020 amid the increased liquidity from policymakers. We uncover this key theme in our quarterly commentary.

September 2020: Global Equity Markets Review

Posted on October 13, 2020

Global equity markets suffered a pullback in September as investors have seen heightened levels of uncertainty surrounding pandemic outcomes and the U.S. general election.

September 2020: Fixed Income Markets Review

Posted on October 13, 2020

Fixed income returns were mixed during the month as interest rate risk has steadily risen for aggregate bonds in this market of historically low yields.

August 2020: Fixed Income Markets Review

Posted on September 9, 2020

Fixed income returns were mixed for the month of August.

August 2020: Global Equity Markets Review

Posted on September 8, 2020

August was another strong month for global equity markets as stocks were propelled higher due to historically large stimulus, rebounding economic activity, and progress toward a vaccine.

WST Ranked by FA Magazine in 2020 RIA Report

Posted on August 12, 2020

WST is pleased to announce it's ranking by FA Magazine for 2020.

July 2020: Fixed Income Markets Review

Posted on August 10, 2020

Fixed income markets experienced positive returns to start 3Q as U.S. corporate credit and international sovereign bond performance helped to bolster the asset class.

July 2020: Global Equity Markets Review

Posted on August 10, 2020

July registered a strong month and was the fourth consecutive month of positive returns coming off the March low.

2Q 2020 Economic & Market Overview

Posted on July 17, 2020

As we pass the halfway point in the year, New Year's Day seems a distant memory. 2020 began with optimism and high expectations for the economy and markets, but that optimism has given way to a general sense of unease and anxiety about the future.

June 2020: Fixed Income Review

Posted on July 16, 2020

June was another positive month for fixed income assets as further Fed support helped to facilitate fully functioning credit markets.

June 2020: Global Equity Markets Review

Posted on July 15, 2020

Global equity markets continued the rally that began in late March, and although with less vigor, June 30th was the best calendar quarter since the 4th quarter of 1998.

May 2020: Fixed Income Market Review

Posted on June 11, 2020

Fixed income assets experienced modest gains during May as credit spread tightening and liquidity injections helped to bolster the asset class.

May 2020: Global Equity Market Review

Posted on June 9, 2020

Equity markets around the world continued to add to April’s rally with a focus on incrementally good news on potential vaccines for COVID–19 and concrete plans for reopening economies.

WST Principals Named to 2020 Inside Business Power List

Posted on May 19, 2020

WST is pleased to share that Wayne Wilbanks, co-founder and Managing Principal, and Larry Bernert, Principal, were once again named to this list.

April 2020: Global Equity Market Review

Posted on May 13, 2020

Investors saw a reversal in trends during the month of April as stocks were propelled by the risk-on sentiment that proliferated throughout global equity markets.

April 2020: Fixed Income Market Review

Posted on May 12, 2020

Fixed income assets experienced tailwinds in April as a result of credit spread tightening and global central bank stimulus acting to stabilize credit markets.

March 2020: Global Equity Market Review

Posted on April 9, 2020

As February ended with a swift sell-off in equities, investors navigated the historic volatility throughout March as growing pandemic fears swept over markets.

March 2020: Fixed Income Market Review

Posted on April 9, 2020

The bullish sentiment in bonds that continued in early 1Q came to a halt in March as pressures emerged across the fixed income universe, prompting the Fed to take monetary actions.

Global Pandemic's Impact on Economy

Posted on March 31, 2020

There are few periods in history where one event has been identified as the root cause of a major market decline. We uncover this theme, as well as COVID-19's impact on the job market.

February 2020: Global Equity Market Review

Posted on March 11, 2020

As the progress of COVID-19 cases escalated and dominated headlines throughout February, equally viral was the impact of the outbreak to economic/ corporate outlook and investor confidence.

January 2020: Global Equity Market Review

Posted on February 10, 2020

After a lights-out finish to 2019 and a strong start to 2020, equity bulls were halted in their tracks mid-month as news broke and rapidly escalated regarding the deadly coronavirus.

January 2020: Fixed Income Market Review

Posted on February 4, 2020

After 4Q’s economic and political positives wilted global bond momentum, chaotic January events and headlines restored the shine to safe-haven assets and fixed income overall.

Wilbanks Smith & Thomas Asset Management, LLC Is Joined by Virginia Capital Strategies

Posted on February 3, 2020

Wilbanks Smith & Thomas Asset Management, LLC (WST) – a Norfolk, Virginia-based wealth management and investment advisory firm – is pleased to welcome under its banner a Roanoke, Virginia-based investment management firm, Virginia Capital Strategies (VCS).

WST Commentary: 4Q 2019 Markets & Economic Update

Posted on January 29, 2020

Investors wrapped the year with a risk-on flourish largely driven by progress around US-China trade negotiations, coordinated monetary easing and an improved global economic backdrop – driving continued momentum in global equities while fixed income markets finished 4Q with modestly positive returns.

Global Equity Market Review - 4Q 2019

Posted on January 6, 2020

4Q marked a strong finish to a stellar year for global equities; investors cheered improving economic and corporate data and market-friendly political progress.

Fixed Income Market Review - 4Q 2019

Posted on January 6, 2020

With investors in “risk-on” mode thanks to improving global fundamentals and political outlook, the 2019 bond rally slowed in 4Q but indices posted strong gains for the year overall.

The SECURE Act: Key 2020 Provisions

Posted on January 6, 2020

On December 20th, 2019, President Trump signed into law a piece of legislation intended to strengthen retirement security, referred to as the Setting Every Community Up for Retirement Enhancement Act, or SECURE Act. WST lists key provisions that took effect on January 1st, 2020.

November 2019 - Fixed Income Market Review

Posted on December 2, 2019

Capital markets flows favored the bolder (i.e., riskier) asset classes in November, with constructive trade discussions and economic data boosting equities and corporate debt while prompting some runoff in global sovereign bonds.

November 2019 - Global Equity Market Review

Posted on December 2, 2019

Equity market strength persisted in November, led by US stocks as investors delivered fresh all-time highs for major US indices.

October 2019 - Global Equity Market Review

Posted on November 4, 2019

Constructive geopolitical and trade headlines lifted global equities in October, with emerging markets leading the pack.

October 2019 - Fixed Income Market Review

Posted on November 4, 2019

Global bond yields continued to sink during October as emerging sovereigns rallied and corporates continued to advance.

Fixed Income Market Review: 3Q 2019

Posted on October 21, 2019

The quarter opened with mixed, if largely muted, results for global bonds in July before a strong August showing, as equities sold off in response to escalating trade conflicts and macroeconomic headlines that continue to upset the global growth outlook.

Global Equity Market Review: 3Q 2019

Posted on October 15, 2019

September results may have teased long-awaited equity rotations – with value topping growth, small-cap outperforming and signs of life observed in ex-US stocks – but 3Q overall evidenced the same themes and performance drivers from 2Q.

WST Commentary: 3Q 2019 Markets & Economic Update

Posted on October 15, 2019

Market activity in the third quarter reflected increasing concern about slowing global growth, rising U.S.-China trade tensions and uncertain central bank policy.

Day of Caring: WST Lends a Hand to JT's Camp Grom

Posted on September 25, 2019

WST participates in Day of Caring 2019 by helping out at JT's Camp Grom in Virginia Beach.

August 2019 - Global Equity Market Review

Posted on September 4, 2019

Following an overall positive result in a quiet July, August saw volatility uncorked and equity markets capitulate as the US-China Trade War escalated and investors connected the dots between worrying aspects of the global macro picture.

August 2019 - Fixed Income Market Review

Posted on September 4, 2019

Global bond markets were back in action in August as equities sold off in response to escalating trade conflicts and macroeconomic headlines that continue to upset the global growth outlook.

July 2019 - Fixed Income Market Review

Posted on August 6, 2019

Global bonds snapped June’s “bull market in everything” to post mixed, if muted, results in a fairly uneventful July.

July 2019 - Global Equity Markets Review

Posted on August 5, 2019

Intermittent retreats aside, it was a lukewarm but positive result for global equity markets in July, propped up by the same core factors and assurances that have carried markets through the last couple of quarters.

2Q 2019 - Global Equity Markets Review

Posted on July 15, 2019

The 2Q 2019 quarter had opened positively – thanks to better-than-feared earnings and soothing tones from central banks – before US-China trade talks unraveled in May, sinking equities and rallying bond prices.

WST Commentary: 2Q 2019 Markets & Economic Update

Posted on July 12, 2019

Market volatility continued in the second quarter but shook out as upside for both stocks and bonds; as of June 30 investors have enjoyed the best start to a year since 1997.

2Q 2019 - Fixed Income Market Review

Posted on July 9, 2019

“An ounce of prevention is worth a pound of cure,” to quote Fed Chair Jay Powell, and it was worth at least 2% to global bond investors in 2Q.

WST Recognized by InvestmentNews

Posted on July 8, 2019

Firm listed among largest fee-only RIAs in the US and second-largest in Virginia.

Markets Buzz, But Is PMI a Fly in the Ointment?

Posted on July 3, 2019

While trade agreement headlines have markets in a celebratory mood, accumulating U.S. economic data speaks to the undertow of slow global growth.

May 2019 - Global Equity Markets Review

Posted on June 5, 2019

As US-China trade talks unraveled in May so too did equity markets, with global stocks down 5.8%. After leading on the upswing for all of 2019, the S&P 500 (down 6.4%) underperformed developed international stocks (-4.7%). Read the full market review here.

May 2019 - Fixed Income Market Review

Posted on June 4, 2019

Core global bonds rallied in May as risk-asset investors digested a mix of sour political tones and an escalation of trade hostilities between the US and China. Read more here.

WST Proud to Lend a Hand: YWCA Adopt-a-Room Project

Posted on May 28, 2019

On May 9th, 2019 the Wilbanks Smith & Thomas team had the pleasure of providing hands-on support for the YWCA Adopt-a-Room Project. Read more, and see the before and after transformation, by clicking here.

WST Principals Named to 2019 Inside Business Power List

Posted on May 20, 2019

WST congratulates Wayne Wilbanks and Larry Bernert for recognition in the 2019 Inside Business Power List.

April 2019 - Fixed Income Markets Review

Posted on May 15, 2019

Core bond markets in April took a breather and saw mixed results as investors continued to expand equity multiples and push risk-asset indices past all-time highs. The month proceeded without disruption to key positive themes including, but not limited to, increased optimism around economic recovery in China. Read more here.

April 2019 Global Equity Markets Review

Posted on May 7, 2019

The month of April proceeded without disruption to key positive themes including increased optimism around economic recovery in China, anticipated resolution of the U.S.-China trade conflict and perhaps most importantly, global central banks tilting highly accommodative.

WST 1Q 2019 Commentary

Posted on April 17, 2019

After enduring a 9% slide in December that led to a 14% decline for the fourth quarter, U.S. stocks began 2019 with their best January since 1987 and their best quarter since 2009. Now, with stocks having recouped almost all of last year’s declines, investors face the same questions and risks that emerged in 2018.

Inflation: What's in a Number?

Posted on April 12, 2019

In his March 20, 2019 news conference, Fed Chairman Jay Powell stated the decision of the Federal Open Market Committee (FOMC) to momentarily pause its interest rate increases. Historically, the Fed will attempt to curb inflation through interest-rate increases and vice-versa, therefore, it is significant what measure of inflation the Fed uses and the level at which it drives their policy decisions. Read more on it here.

1Q 2019 Fixed Income Markets Review

Posted on April 11, 2019

Bond investors in 1Q 2019 were treated to falling yields and an equity-like credit rally as central banks worked to keep the economic plates spinning. Read more.

1Q 2019 Global Equity Markets Review

Posted on April 10, 2019

With spirits lifted by accommodative tones in everything from central bank pressers to trade discussions, investors put the 4Q meltdown in the rearview and sent global stocks up around 12.3% in the first quarter of 2019.

February 2019 Fixed Income Markets Review

Posted on March 6, 2019

January’s risk-on tide managed to lift all boats, but February saw bonds hew more closely to conventional market “wisdom” and results were mixed as equities continued to climb.

February 2019 Global Equity Markets Review

Posted on March 5, 2019

February set global stocks in the double digits year to date, with US small cap topping markets and emerging equities softening as currency impacts reversed.

January 2019 Fixed Income Markets Review

Posted on February 4, 2019

Capital markets opened the new year in a decidedly risk-on mood, but global fixed income was no worse for the wear.

January 2019 Global Equity Markets Review

Posted on February 4, 2019

The clouds parted for global markets in January, delivering high-single- or low-double-digit returns across essentially all equity geographies and styles.

WST Ranked Among Top Fee-Only RIAs in the US Southeast

Posted on January 17, 2019

WST is pleased to announce its recognition by InvestmentNews.

US Labor Market: A Bright Star, But Is It Burning Too Hot?

Posted on January 14, 2019

While overall highly positive for the US economy, the condition of the labor market does drive mixed impacts across other metrics of economic health, including wage growth, productivity, inflation and interest rates.

WST 4Q 2018 Commentary

Posted on January 8, 2019

As the fourth quarter progressed, the challenges and concerns increased in visibility and severity, leading investors to reassess risk exposures and ratchet down return expectations. Volatility exploded, and prices fell in virtually all asset classes except bonds as the market reacted to daily and even hourly news bytes. Read more on 4Q 2018 here.

December 2018 Fixed Income Markets Review

Posted on January 4, 2019

Fixed income broad markets delivered a strong close to the 2018 year, with yields falling across core indices and sectors as global equities entered a tailspin driven by heavy losses in the US.

December 2018 Global Equity Markets Review

Posted on January 3, 2019

Relief from November’s global equity rally proved short-lived as December saw markets routed by the same anxieties that have plagued investors with varying intensity throughout 2018. Read more here.

December-End Audio Commentary

Posted on December 24, 2018

In our most recent audio commentary, Chief Investment Officer Wayne Wilbanks provides current thinking after a particularly rough ride in December.

November 2018 Fixed Income Markets Review

Posted on December 5, 2018

Fixed income broad-markets offered a strong showing throughout a choppy November. While risk-off sentiment periodically got the better of equities during the month, core US bonds rose steadily and emerging markets were the overall leader.

November 2018 Global Equity Markets Review

Posted on December 5, 2018

Markets opened sharply higher in November but quickly gave way to a back-and-forth affair reflecting a cross-current of political, trade and monetary headlines.

WST Capital Management Named Top Guns Manager for 3Q 2018

Posted on November 27, 2018

Informa Investment Solutions names WST Capital Management Top Guns Manager for the third quarter of 2018.

High Yield: Week in Review

Posted on November 19, 2018

On the heels of a rough week for high yield, we're sharing observations on credit markets and perspective on these concepts in relation to portfolio positioning.

October 2018 Fixed Income Markets Review

Posted on November 5, 2018

After a calm and steady, if not stellar, 3Q for fixed income, October gave way to a painful ride in global capital markets.

October 2018 Global Equity Markets Review

Posted on November 2, 2018

After a placid, positive 3Q, October opened the floodgates for global equity markets and delivered the second 10% correction in 2018. Defensive assets, styles and sectors benefitted from a risk-off rotation, while the month exacerbated painful trends in emerging markets.

WST 3Q 2018 Commentary

Posted on October 15, 2018

Investors set aside concerns about Fed tightening, rising interest rates, trade wars and deficit spending, focusing instead on the strength of the domestic economy and robust corporate profit growth in 3Q of 2018. The U.S. economic recovery is in its 10th year, and the current expansion is the second longest since World War II.

VSCPA Specialized Knowledge Day: Presentation by Paul Ferwerda, CFA

Posted on October 5, 2018

VSCPA will be holding their Specialized Knowledge Day; a day-long program that will take place at the Chesapeake Conference Center. WST is pleased to feature in this year's line-up of speakers. Find registration information here.

August 2018 Global Equity Markets Review

Posted on September 12, 2018

US stocks plowed ahead in August, propping up global equities as emerging markets continued to struggle.

Hurricane Florence Update & Information

Posted on September 11, 2018

Important information for September 13th – 14th.

August 2018 Fixed Income Markets Review

Posted on September 6, 2018

In August, returns were positive across the board for US broad fixed income markets and sectors, but short-duration and floating-rate bonds gave way to duration for the first period in many months.

WST Capital Management Named Top Guns Manager by Informa Investment Solutions

Posted on September 5, 2018

WST Capital Management, a division of Wilbanks Smith & Thomas, has been awarded a Top Guns designation by Informa Investment Solutions’ PSN manager database.

U.S. Consumer Confidence Climbing Towards 18-Year High

Posted on August 31, 2018

In August the Index hit its highest level since October 2000, but the data shows higher confidence in current conditions than in the immediate future.

July 2018 Fixed Income Markets Review

Posted on August 8, 2018

While not positive overall for global fixed income markets, July’s mixed returns saw losses less severe than the prior month, while some sectors strengthened.

July 2018 Global Equity Markets Review

Posted on August 8, 2018

After mixed results in June of 2018, global stocks enjoyed strong returns in July.

WST Ranked by FA Magazine in Annual RIA Report

Posted on August 1, 2018

Wilbanks Smith & Thomas was ranked by Financial Advisor (FA) Magazine among 100 of the largest US RIAs.

Wilbanks, Smith & Thomas Named One of P&I’s Largest Money Managers

Posted on July 24, 2018

Wilbanks, Smith & Thomas Asset Management, LLC (WST), Virginia-based asset management firm, is pleased to announce recognition by Pensions & Investments (P&I) in recently-published 45th annual Largest Money Manager Special Report.

WST 2Q 2018 Commentary

Posted on July 15, 2018

With optimism about positive economic fundamentals tempered by concerns about a potential trade war, interest rates and corporate earnings, financial markets responded to new and evolving challenges in the second quarter. Our quarterly economic and markets commentary includes a discussion of key themes and factors that drove higher volatility and wider dispersion of asset class returns in 2Q.

Milestones Without Context? The 10-year Treasury Yield Hits 3%

Posted on May 8, 2018

In late April, headlines balked at a US 10-Year Treasury yield above 3% for the first time in several years. Is that threshold even significant, and what might it mean for equities?

WST 1Q 2018 Commentary

Posted on April 12, 2018

Right on cue volatility returned to the global investment markets in the first quarter of 2018 as the sanguine complacency of 2017 gave way to broad concerns.

War of the Worlds - The Enemy is Us?

Posted on March 26, 2018

When it comes to our opinions, our “better nature” may go against our instincts.

Cybersecurity Insights & Best Practices

Posted on February 12, 2018

At WST, our cybersecurity efforts are robust, constantly evolving and a critical focus for our firm. However, because identity theft lays the groundwork for fraud, we believe client education is the best defense against cybercrime resulting in financial loss.

Quick Thoughts on the Past Week: US Equities

Posted on February 6, 2018

While the market sell-off has understandably unsettled many investors, we are encouraging our clients not to be spooked by what we view as “normal” market behavior.

WST 4Q 2017 Commentary

Posted on January 17, 2018

We struggled mightily this quarter to find quotes that capture a moment where economic and market momentum is so strong and risk so underappreciated.

Life In the Fast Lane

Posted on December 13, 2017

A continuously connected world poses unique challenges to investors; is it possible to be a patient investor in a world set to hyper speed?

WST Capital Management Named Top Guns Manager by Informa Investment Solutions

Posted on December 8, 2017

WST Capital Management, a division of Wilbanks Smith & Thomas Asset Management LLC, has been awarded a Top Guns designation by Informa Investment Solutions’ PSN manager database, North America’s longest running database of investment managers. The firm received Top Gun recognition for Credit Select Risk-Managed in the ETF US Fixed

A Minsky Moment

Posted on November 28, 2017

Confirmation bias will cause our confidence in our assumptions to swell the longer the uptrend lasts and the more money is invested in the trend.

WSTCM Credit Select Risk-Managed Fund Recognized by Morningstar

Posted on November 16, 2017

Norfolk, Virginia-based investment manager Wilbanks Smith & Thomas Asset Management LLC (WSTAM) is pleased to announce positive recognition of its WSTCM Credit Select Risk-Managed Fund (“the Fund”) by Morningstar, the noted fund research provider.

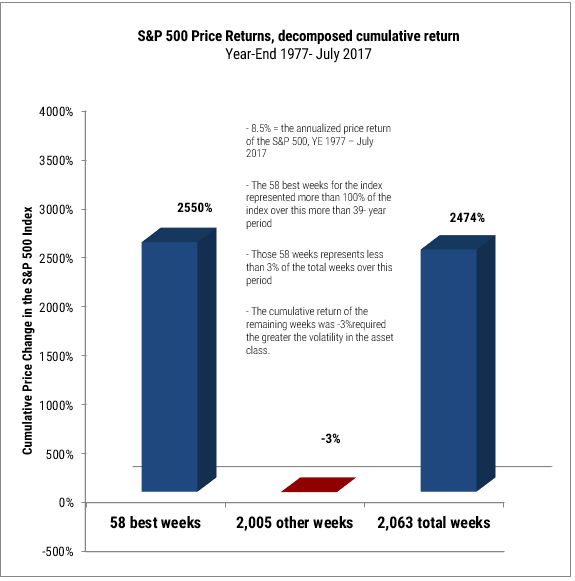

Just the Facts, Ma'am

Posted on November 2, 2017

When faced with making important decisions about long-term investments, we want to be confident in our sense that we can predict the future. The truth, however, is that uncertainty is part of life and also a distinct fact of investing in stock markets.

Great Expectations

Posted on October 20, 2017

A basic truth about investing in stocks is this: their value is a derivation of the collective wisdom of the crowd.

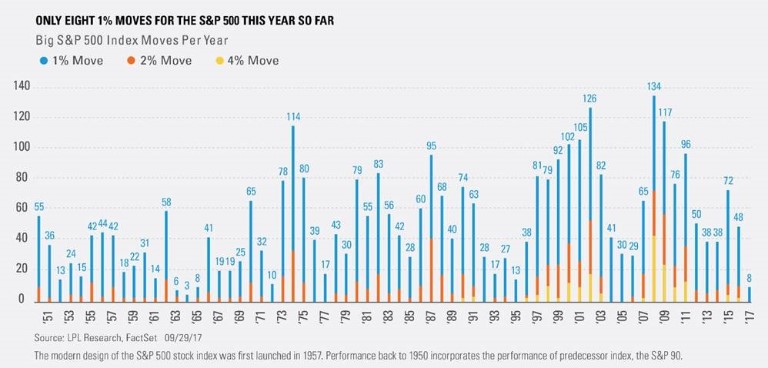

WST 3Q 2017 Quarterly Commentary

Posted on October 15, 2017

The global "bull market in everything" continued in the third quarter with stocks around the world finishing at all-time highs, bond yields hovering near all-time lows, credit spreads continuing to narrow, and private equity, debt, and real estate funds all reporting preliminary results in line with the strong returns in the public markets.

Equifax Data Breach: Information & Guidance for WST Clients

Posted on September 22, 2017

As news circulates of the recent Equifax data breach, our goal is to ensure you are aware of the situation and equipped with accurate information and trusted risk management resources.

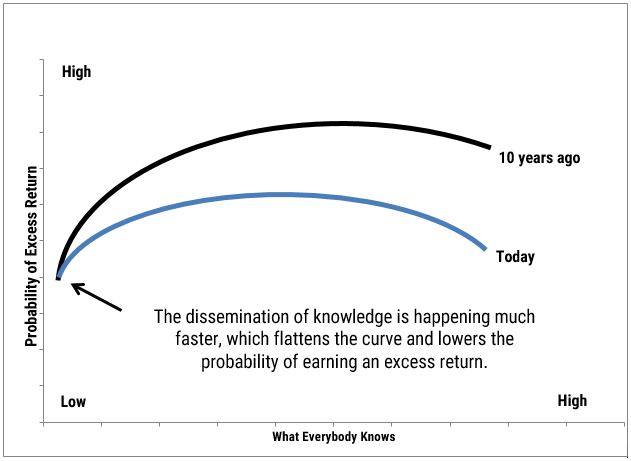

Everybody Knows

Posted on August 28, 2017

Information flows faster than ever today in our daily lives and in the financial markets.

Trying to Reason with Hurricane (and Earnings) Season

Posted on August 22, 2017

The Atlantic hurricane season lasts for six months, approximately from early to June to late November, with a peak in activity each year around mid-September. Equity investors, too, have a watchful season.

Money for Nothing?

Posted on August 11, 2017

Among investors, one of the more hotly debated economic topics is how well behaved inflation data is, as we begin the ninth year of the current economic expansion.

Revisiting Risk in an Euphoric Market Environment

Posted on July 19, 2017

The existence of a trade-off between the opportunities for gain against the possibility of loss is not in debate. Nor are the mathematical calculations behind each side of the equation subject to argument. However, where investors do take sides is what the definition of risk really means.

WST Featured in RIA Rankings Published by Financial Advisor Magazine

Posted on July 17, 2017

WST featured in RIA Rankings Published by Financial Advisor Magazine

Wilbanks Smith & Thomas was recently named in the 2017 Top RIA Ranking produced by Financial Advisor Magazine. The voluntary survey, published in this month’s edition of the magazine[1], comprises a list of 638 Registered Investment Advisory firms reporting from

WST 2Q 2017 Commentary

Posted on June 30, 2017

As always the most important consideration in portfolio construction is each clients’ individual financial situation, so communication is the key to success.

The Knowledge Illusion

Posted on June 27, 2017

At the center of Socrates’ objection to written word was a phenomenon known as the knowledge illusion. It arises because we fail to distinguish what is in our own head from that which is in other people’s heads.

O Brother, Where Art Thou? Thoughts on Surging Stocks, the Fed and Hidden Treasure

Posted on June 19, 2017

An analysis of market breadth (or lack) of participation by the average stock in the indexes can usually be argued from both sides.

WST on Bloomberg TV: November 2016

Posted on November 11, 2016

Wayne Wilbanks, chief investment officer at Wilbanks Smith & Thomas Asset Management, discusses the market rally following the election of Donald Trump, U.S. valuations and the outlook for the bond market. He speaks to Bloomberg's Betty Liu and Yvonne Man on "Bloomberg Daybreak: Asia." (Source: Bloomberg)

This information presented in any

WST on Bloomberg TV: August 2016

Posted on August 30, 2016

Wayne Wilbanks, chief investment officer at Wilbanks, Smith & Thomas Asset Management, discusses the low volumes in the markets, the timing of the next Fed rate hike and negative interest rates. He speaks to Bloomberg's Ramy Inocencio and Yvonne Man on "Daybreak Asia." (Source: Bloomberg)

This information presented in any of

WST on Bloomberg TV: May 2016

Posted on May 24, 2016

Wayne Wilbanks, chief investment officer at Wilbanks, Smith & Thomas Asset Management, discusses the rally in U.S. stocks with Bloomberg's Angie Lau on "First Up." (Source: Bloomberg)

This information presented in any of the above publications/media appearances represents opinions of Wilbanks Smith & Thomas and are subject to change from time

WST on Bloomberg TV: April 2016

Posted on April 13, 2016

Wayne Wilbanks, chief investment officer at Wilbanks Smith & Thomas Asset Management, discusses U.S. earnings season, its impact on the markets and his strategy for investors. He speaks to Bloomberg's Angie Lau on "First Up." (Source: Bloomberg)

This information presented in any of the above publications/media appearances represents opinions of Wilbanks

WST on Bloomberg TV: February 2016

Posted on February 5, 2016

Wayne Wilbanks, chief investment officer at Wilbanks, Smith & Thomas Asset Management, discusses the possibility of a U.S. recession. He speaks with Bloomberg’s Angie Lau on "First Up." (Source: Bloomberg)

This information presented in any of the above publications/media appearances represents opinions of Wilbanks Smith & Thomas and are subject to