November 2018 Global Equity Markets Review

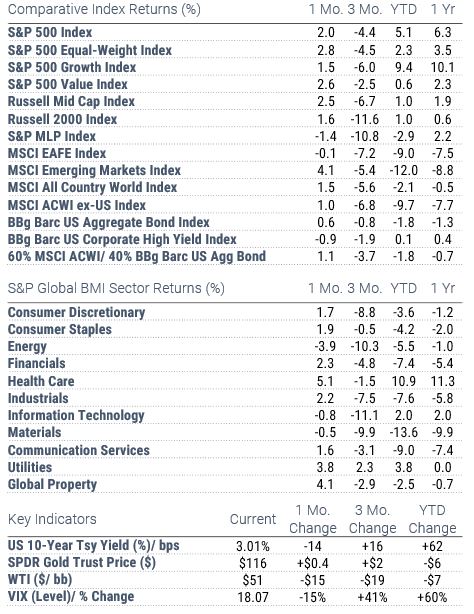

Markets opened sharply higher in November but quickly gave way to a back-and-forth affair that had global equities down nearly 6% mid-month before they rallied in the final few sessions. The MSCI All Country World Index ultimately closed out the month up 1.5%, while the S&P 500 gained 2.0%, clawing back from a peak-to-trough drawdown of more than 7%. Developed non-US stocks (as measured by the MSCI EAFE Index) suffered comparatively less in the sell-off but were lackluster in the rally and overall shed approximately 20 basis points. Despite continued risk-off sentiment and having lead markets downward in the prior month, emerging markets equities (+4.1%) outperformed even on the downside, remaining in the black the entire period. Volatility trends were muted, with the VIX – the CBOE Volatility or so-called “Fear Index” – down 15% versus October-end and down 25% versus October’s peak (a 6-month high).

Quarter to date equity indices are down. Positive year-to-date and one-year numbers feature exclusively in the US, skewing sharply to large cap as small- and mid-cap peers recover at a slower pace from a steeper fall over the last two months. At the close of 3Q US small caps were nearly 1% ahead of the S&P 500 on a year-to-date basis but now lag by around 400 basis points for the year. S&P 500 Value stocks held up far better than growth counterparts, down 4.9% versus 8.1% peak-to-trough during the month. While still significant, the 8.8% year-to-date performance gap between Value and Growth has narrowed significantly from the nearly 1400 basis point spread that existed at the start of 4Q.

Mid-term election results (and the implied 2-year political gridlock) afforded welcome, if expected, news for the markets at the tail end of a strong opening bounce. Within days however that rally had been dissolved by forces that felt familiar; as in October, there was no clear or single catalyst, but rather accumulated concerns about a synchronized slowdown in global growth exacerbated by trade tensions and falling oil price. Headlines seemed finally to acknowledge the potential impact of tariffs on households and consumer confidence, even as that metric remained strong and data confirmed that inflation remains subdued (oil prices went from a fading rally to a tailspin during the month). While November closed out a strong reporting period, markets seemed to realize some angst around the idea that corporate earnings in the US may finally have peaked. In the end, however, investors rallied on encouragement from dovish comments by Fed Chairman Jay Powell as well as some relaxation in US trade hostilities and some signs of progress in the UK’s Brexit negotiation.

Spotlight: Chinese Equities

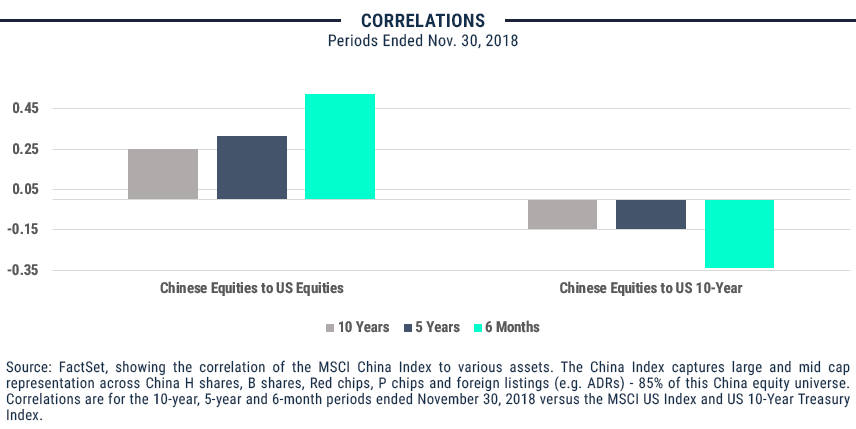

Emerging markets’ market-topping return in November was attributable largely to a bounce in Chinese equities (+7.2%) off a nearly 21% loss for the six-month period ended October 31st (roughly coinciding with the US/ China trade war initiated in late June). Alongside the US, Chinese stocks mounted a nearly rally that proved stronger and a bit stickier than the US’s and was cemented in the final days of the month largely by two things: signs of a cease-fire in ongoing tariff hostilities and Fed Chair comments indicating that US rate hikes may be petering out.

Effects of the trade war are suggested in the strengthened relationship between US and Chinese equities over the period – the six-month correlation stands at roughly 2x the 10-year correlation and reached the highest level since December 2000. Fed action in the US, likewise, has a been an increasingly strong headwind for Chinese equities, as rate hikes have narrowed the spread between Treasuries and Chinese debt that is considered much riskier–introducing lower-risk competition for the same capital China is attempting to attract. The inverse correlation between Chinese stocks and US rates stands at more than 2x the 10-year level.

Besides attributed information, this material is proprietary and may not be reproduced, transferred or distributed in any form without prior written permission from WST. WST reserves the right at any time and without notice to change, amend, or cease publication of the information. This material has been prepared solely for informative purposes. The information contained herein may include information that has been obtained from third party sources and has not been independently verified. It is made available on an “as is” basis without warranty. This document is intended for clients for informational purposes only and should not be otherwise disseminated to other third parties. Past performance or results should not be taken as an indication or guarantee of future performance or results, and no representation or warranty, express or implied is made regarding future performance or results. This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security, future or other financial instrument or product.