February 2020: Global Equity Market Review

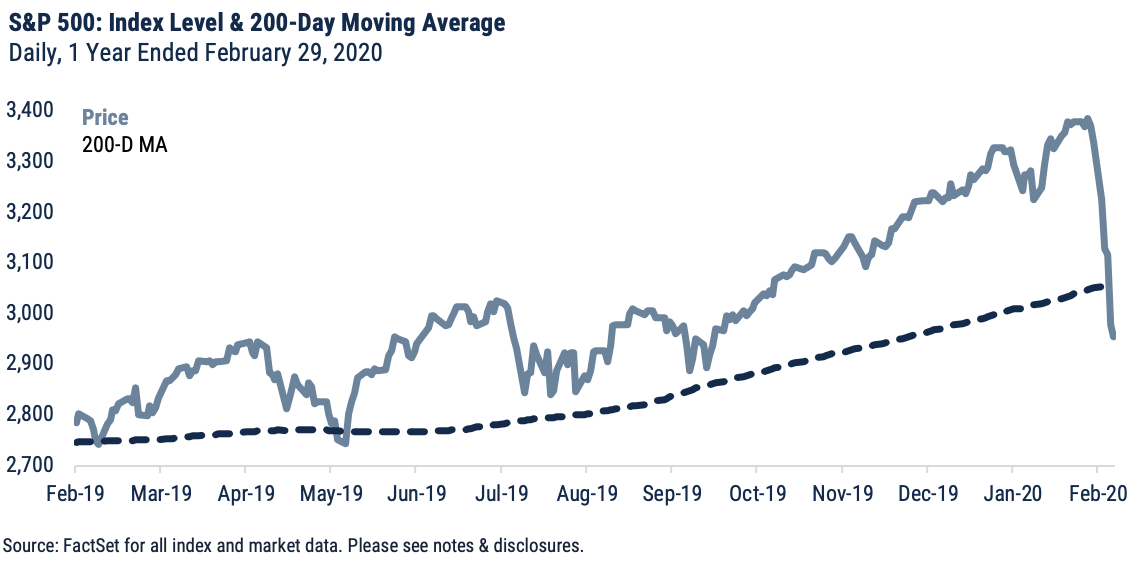

As the physical progress of COVID-19 was made clear in escalating news reports and global health advisories, equally viral was the impact to economic/ corporate outlook and investor confidence in February. During the month the virus fully replaced trade as the market focus, unwinding in just the last few trading sessions the month’s earlier advances that had occurred off earnings surprises, improving business surveys and the assumption that the virus would be contained easily. The damage to equities became a headline fixation, and all said the month dealt the S&P 500 its fastest-ever 10% correction, crumbling the index from a record high on February 19th to a level well below the 200-day moving average.

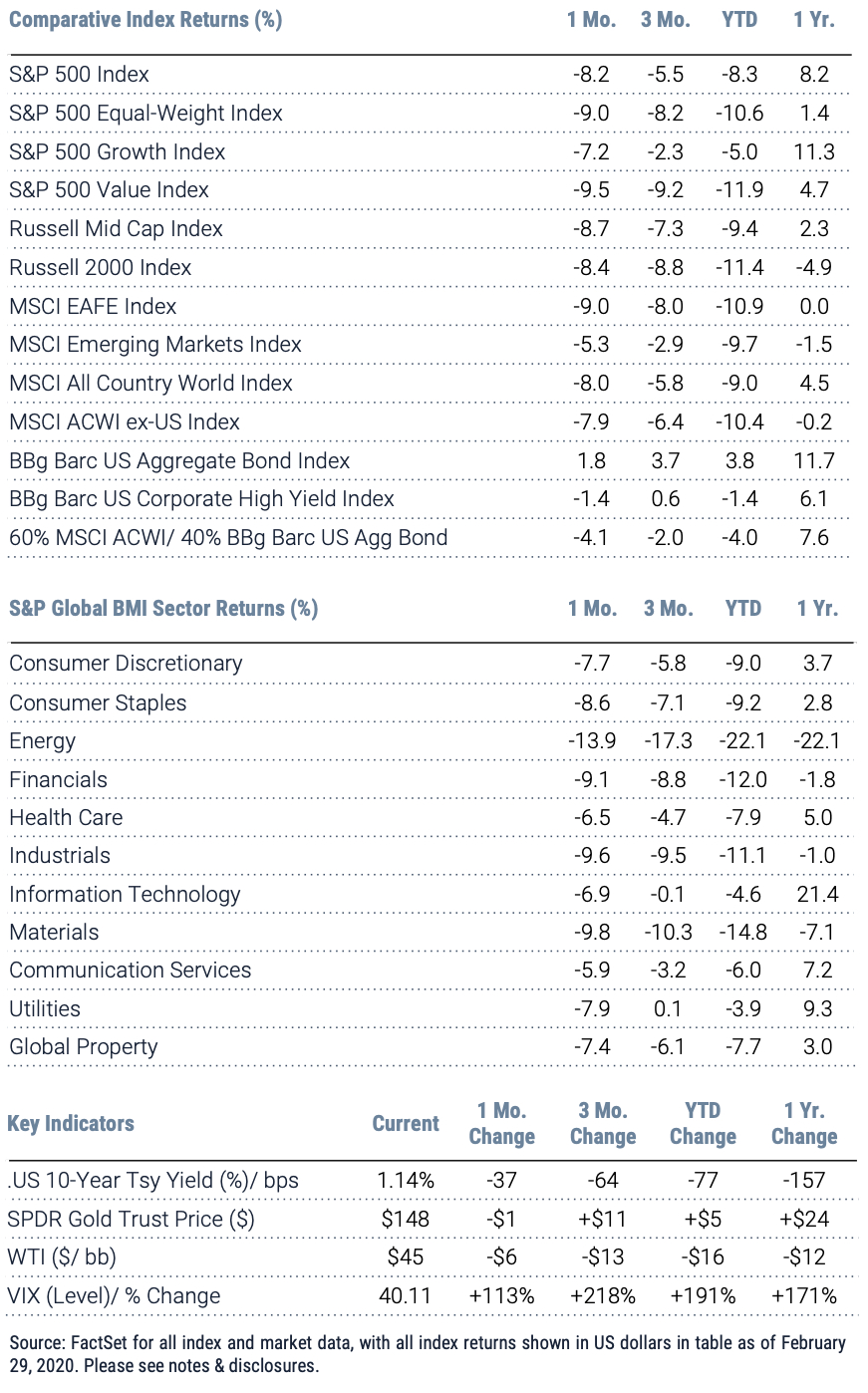

Global equities, as measured by the MSCI ACWI, returned -8.0% for the month in USD and -7.6% in local currency terms; an 8.2% loss for the S&P 500 led the way downward. While sell-off breadth was considerable, value and small-cap underperformed, reflecting particular pressure in Energy and Financials. The S&P 500 Growth Index, buoyed relatively by Technology and large health care names, shed 7.2% versus 9.5% for the S&P 500 Value, silencing completely a factor rotation trend that had emerged in late 2019. The S&P 500 Equal-Weight Index correspondingly underperformed, declining 9.0%.

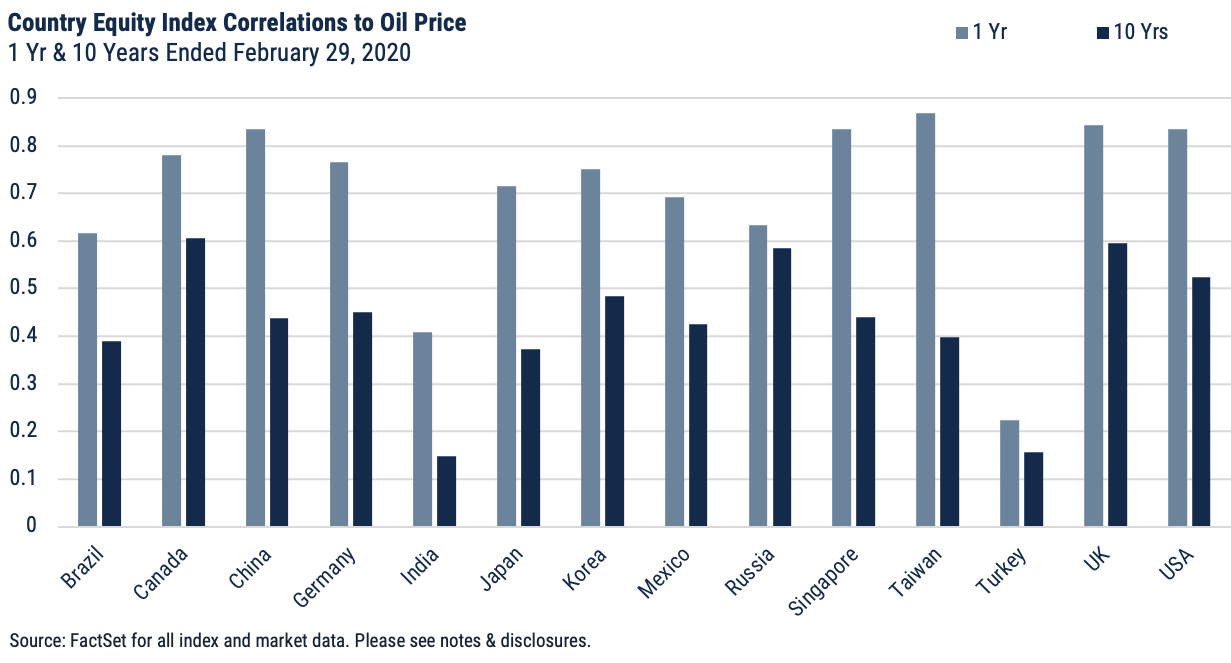

Global sector performance reflected, initially, concerns around virus impact on supply chains but as the virus spread the sell-off reflected demand concerns as well. Compounding steep January losses, oil prices slipped nearly 15% to dip below $50 USD – triggering a disinflation-sensitive viewpoint in sector leadership and preventing rate-sensitive or higher-yielding sectors (Utilities, for example) from outperforming by a more typical margin in such a violent sell-off. Energy was, predictably, the worst-performing sector, while the least severe losses were seen in Technology, Health Care and Communication Services – sectors that have achieved an association with consumer durability and quality.

Ex-US equities were marginally better than the US at -7.9% USD (-6.8% local), but EAFE (-9.0% USD) dragged. Lagging economic data in Europe reflected receding pressure from the trade war, Brexit and other fundamental bottoms that occurred in late 2019; flash PMI data, however, showed early evidence of virus headwinds. All said, Japan, the United Kingdom, Germany, Switzerland and France all fell between 7-9%, in aggregate underperforming the US in dollar terms (faring slightly better in local currency). The Yen improved modestly against the dollar while the Euro and pound weakened.

Emerging markets equities were a dark-horse outperformer, shedding just 5.3% USD (-3.8% local). China, a third of the index, managed a roughly 1% advance in USD and local terms, as virus cases peaked and economic activity began to stir to the positive after an aggressive, successful containment effort since the start of the year. Taiwan was only modestly negative, buoyed by the inflection point assumed in mainland China. Other major emerging economies were negative, with Korea – a 12% index weight – down 9% local and absorbing another 400 basis points in negative currency impact. Currency exacerbated losses to a similar extent in oil-driven Russia and Brazil, and Mexico struggled against a strengthening dollar. All said, China and relatedly Taiwan were the major hedge for emerging equities in February.

Important Disclosures

Index Returns – all shown in US dollars

All returns shown trailing 2/29/2020 for the period indicated. “YTD” refers to the total return as of prior-year end, while the other returns are annualized. 3-month and annualized returns are shown for:

- The S&P 500 index is comprised of large capitalized companies across many sectors and is generally regarded as representative of US stock market and is provided in this presentation in that regard only.

- The S&P 500® Equal Weight Index (EWI) is the equal-weight version of the widely-used S&P 500. The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight - or 0.2% of the index total at each quarterly rebalance. The S&P 500 equal-weight index (S&P 500 EWI) series imposes equal weights on the index constituents included in the S&P 500 that are classified in the respective GICS® sector.

- The S&P 500 Growth Index is comprised of equities from the S&P 500 that exhibit strong growth characteristics and is weighted by market-capitalization.

- The S&P 500 Value Index is a market-capitalization weighted index comprising of equities from the S&P 500 that exhibit strong value characteristics such as book value to price ratio, cash flow to price ratio, sales to price ratio, and dividend yield.

- The Russell 3000 Index tracks the performance of 3000 U.S. corporations, determined by market-capitalization, and represents 98% of the investable equity market in the United States.

- The Russell Mid Cap Index measures the mid-cap segment performance of the U.S. equity market and is comprised of approximately 800 of the smallest securities based on current index membership and their market capitalization.

- The Russell 2000 Index is a market-capitalization weighted index that measures the performance of 2000 small-cap and mid-cap securities. The index was formulated to give investors an unbiased collection of the smallest tradable equities still meeting exchange listing requirements.

- The MSCI All Country World Index provides a measure of performance for the equity market throughout the world and is a free float-adjusted market capitalization weighted index.

- The MSCI EAFE Index is a market-capitalization weighted index and tracks the performance of small to large-cap equities in developed markets of Europe, Australasia, and the Far East.

- The MSCI Emerging Markets Index is a float-adjusted market-capitalization index that measures equity market performance in global emerging markets and cannot be purchased directly by investors.

- The S&P Global BMI sector indices are into sectors as defined by the widely used Global Industry Classification Standards (GICS) classifications. Each sector index comprises those companies included in the S&P Global BMI that are classified as members of respective GICS® sector. The S&P Global BMI Indices were introduced to provide a comprehensive benchmarking system for global equity investors. The S&P Global BMI is comprised of the S&P Emerging BMI and the S&P Developed BMI. It covers approximately 10,000 companies in 46 countries. To be considered for inclusion in the index, all listed stocks within the constituent country must have a float market capitalization of at least $100 million. For a country to be admitted, it must be politically stable and have legal property rights and procedures, among other criteria.

- The Barclay’s US Aggregate Index, a broad based unmanaged bond index that is generally considered to be representative of the performance of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

- The Bloomberg Barclay’s US Corporate High Yield Index, which covers the USD-denominated, non-investment grade, fixed-rate, taxable corporate bond market.

Key Indicators

Key Indicators correspond to various macro-economic and rate-related data points that we consider impactful to equity markets.

- The US 10-Year Treasury Yield (%)/bps, is the return on investment for the U.S. government’s 10-year debt obligation and serves as a signal for investor confidence.

- SPDR Gold Trust Price ($), is an investment fund that reflects the performance on the price of a gold bullion, less the Trust’s expenses.

- West Texas Intermediate, which is an oil benchmark and the underlying asset in the New York Mercantile Exchange’s oil futures contract.

- CBOE Volatility Index (Level)/% Change, which uses price options on the S&P 500 to estimate the market's expectation of 30-day volatility.

This document is intended for informational purposes only and should not be otherwise disseminated to other third parties. Past performance or results should not be taken as an indication or guarantee of future performance or results, and no representation or warranty, express or implied is made regarding future performance or results. This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security, future or other financial instrument or product. This material is proprietary and being provided on a confidential basis, and may not be reproduced, transferred or distributed in any form without prior written permission from WST. WST reserves the right at any time and without notice to change, amend, or cease publication of the information. This material has been prepared solely for informative purposes. The information contained herein includes information that has been obtained from third party sources and has not been independently verified. It is made available on an "as is" basis without warranty and does not represent the performance of any specific investment strategy.

We consider an index to be a portfolio of securities whose composition and proportions are derived from a rules-based model. See the appropriate disclosures regarding models, indices and the related performance. You cannot invest directly in an index and the performance of an index does not represent the performance of any specific investment. Some of the information enclosed may represent opinions of WST and are subject to change from time to time and do not constitute a recommendation to purchase and sale any security nor to engage in any particular investment strategy.

Past performance or results should not be taken as an indication or guarantee of future performance or results, and no representation or warranty, express or implied is made regarding future performance or results.

Besides attributed information, this material is proprietary and may not be reproduced, transferred or distributed in any form without prior written permission from WST. WST reserves the right at any time and without notice to change, amend, or cease publication of the information. This material has been prepared solely for informative purposes. The information contained herein may include information that has been obtained from third party sources and has not been independently verified. It is made available on an “as is” basis without warranty. This document is intended for clients for informational purposes only and should not be otherwise disseminated to other third parties. Past performance or results should not be taken as an indication or guarantee of future performance or results, and no representation or warranty, express or implied is made regarding future performance or results. This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security, future or other financial instrument or product.