April 2020: Fixed Income Market Review

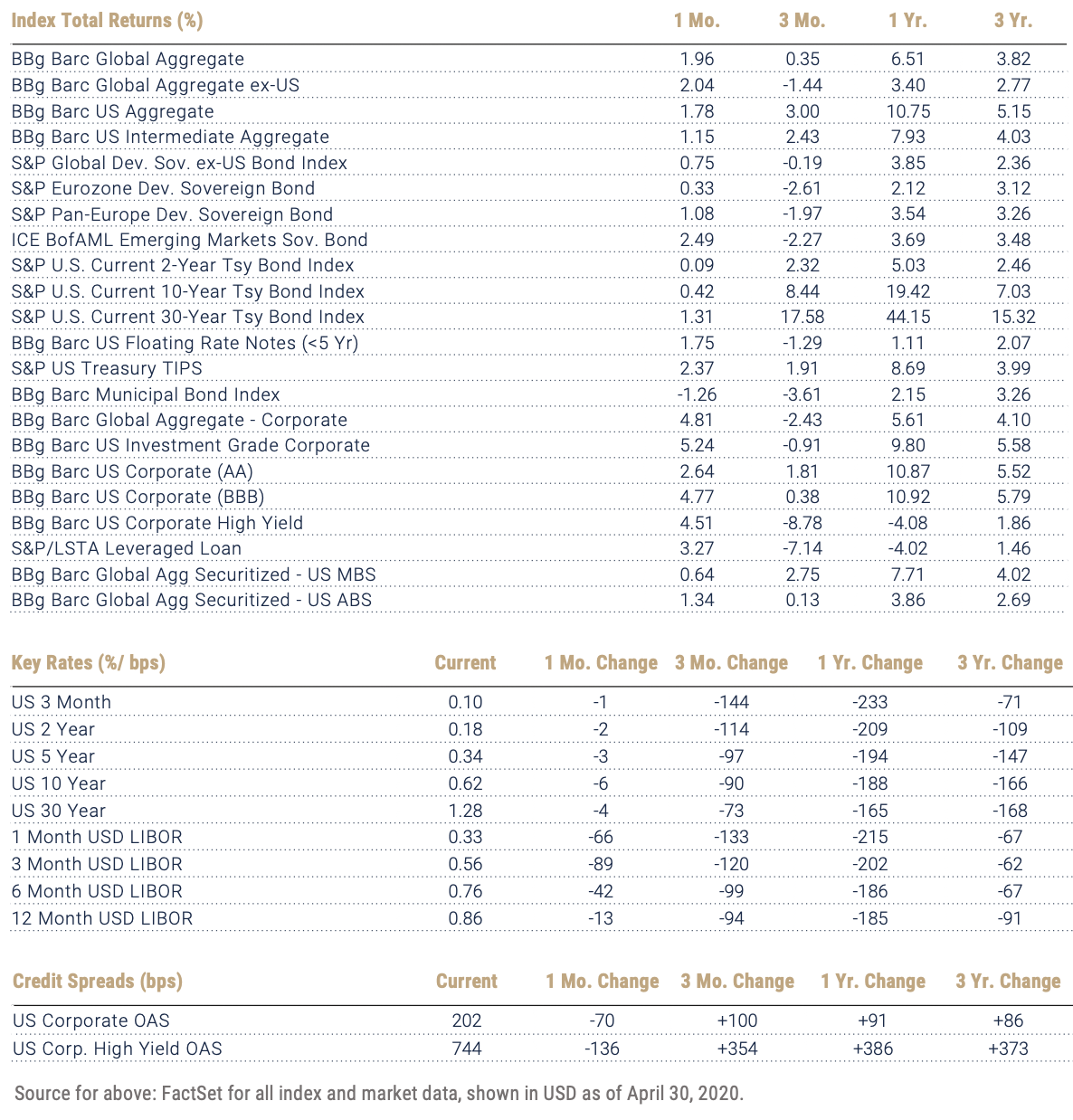

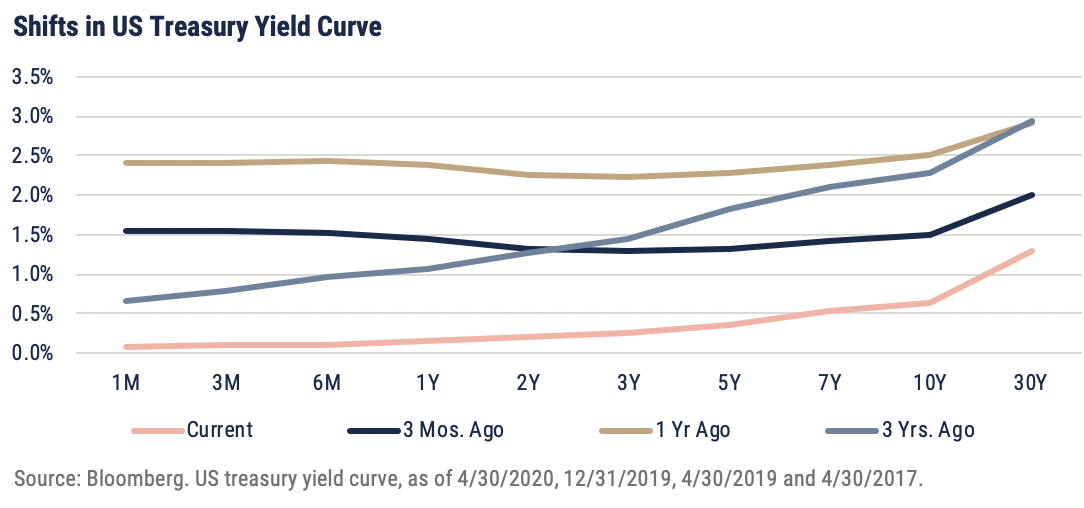

Following one of the most volatile months on record, fixed income assets rallied in April. While most sectors posted positive returns for the month, investment grade corporate credit outperformed as central banks stabilized markets and expectations that economies may start reopening increased. Treasury yields were roughly unchanged – with the strong performance in credit driving the US Aggregate’s return of 1.78%.

While they remain elevated compared to just three months ago, credit spreads tightened during the month of April. US investment grade corporate spreads contracted by 70 basis points while high yield spreads tightened by 136 basis points. The latter benefited from announcement by the Fed earlier in the month who stated high yield ETFs and some fallen angel bonds would be added to their basket of eligible securities for purchase. However, the energy sector weighed down the high yield index a few weeks later after front month crude oil futures traded at negative prices for the first time in history. In addition to the Fed’s announcement regarding the eligibility of high yield bonds, they continued to purchase US treasuries and agency mortgage-backed securities. Over the course of the month, the Fed acquired an additional $760 billion of securities, bringing the value of the System Open Market Account to $5.5 trillion. To put this into perspective, between November 2010 and June 2011, the Fed purchased roughly $600 billion of US treasury securities during the second round of quantitative easing.

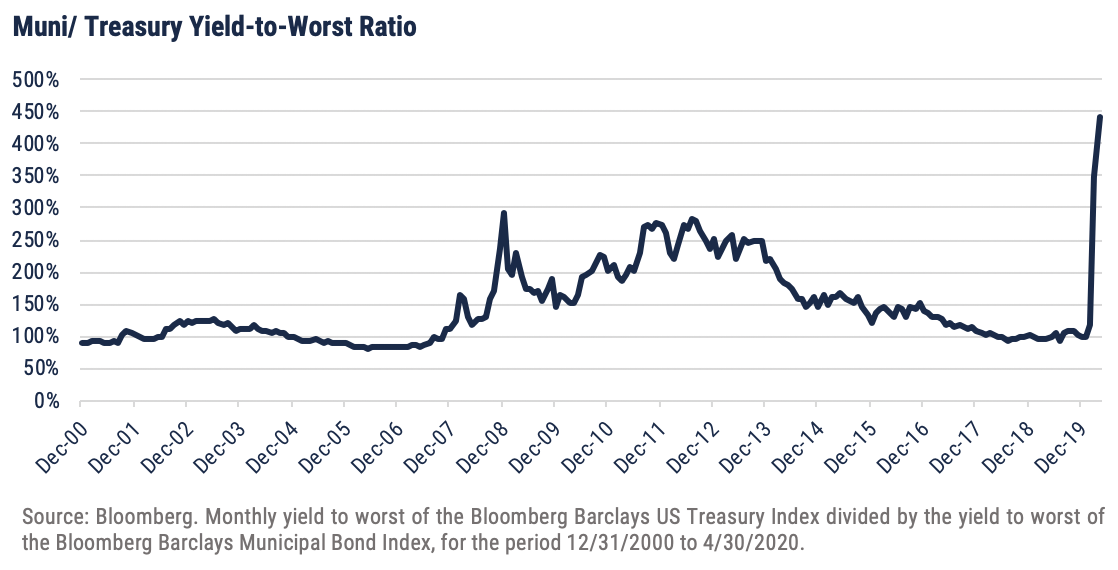

Although credit markets have stabilized, investors have been selective about where they allocate capital, as evident by the 1,000 basis points year-to-date performance difference between US investment grade and high yield corporate bonds. High quality issuers have outperformed while market participants have avoided other issuers most affected by the pandemic, such as those in the transportation and leisure industries. Even highly rated municipal issuers have been shunned, pushing the municipal/treasury yield ratio to levels not seen since 2008. Although many of these issuers have increased their reserve balances since then, there are rising concerns they will receive lower income and sales tax receipts over the coming quarters. As a result, their ability to fund obligations such as pension contributions may be weakened.

With the pandemic’s impact on the economy far from certain, market participants may continue to observe higher volatility in yields and credit spreads for the next couple months, perhaps even the rest of the year.

Important Disclosures

Index Returns – all shown in US dollars

All returns shown trailing 12/31/2019 for the period indicated. “YTD” refers to the total return as of prior-year end, while the other returns are annualized. 3-month and annualized returns are shown for:

- The Barclay’s US Aggregate Index, a broad based unmanaged bond index that is generally considered to be representative of the performance of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

- The ICE BofAML Emerging Markets Sovereign Bond Index is a subset of The BofA Merrill Lynch World Sovereign Bond Index excluding all securities with a country of risk that is a member of the FX G10, all Western European countries, and territories of the U.S. and Western European countries. The FX G10 includes all Euro members, the U.S., Japan, the U.K., Canada, Australia, New Zealand, Switzerland, Norway, and Sweden.

- The Bloomberg Barclays Global Aggregate Index, which measures global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

- The S&P Global Developed Sovereign Bond index includes local-currency denominated debt publicly issued by governments in their domestic markets.

- S&P Eurozone Developed Sovereign Bond - seeks to measure the performance of Eurozone government bonds.

- The S&P Pan-Europe Developed Sovereign Bond Index is a comprehensive, market-value-weighted index designed to track the performance of local currency-denominated securities publicly issued by Denmark, Norway, Sweden, Switzerland, the U.K. and developed countries in the Eurozone for their domestic markets.

- ICE BofAML Emerging Markets Sovereign Bond - tracks the performance of US dollar (USD) and Euro denominated emerging markets non-sovereign debt publicly issued within the major domestic and Eurobond markets.

- The Bloomberg Barclay’s US Corporate Bond Index (AA), which measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers.

- The Bloomberg Barclay’s US Corporate High Yield Index, which covers the USD-denominated, non-investment grade, fixed-rate, taxable corporate bond market.

- Bloomberg Barclay’s Global Aggregate Securitized- US Mortgage-Backed Securities, which is a component of the Bloomberg Barclay’s US Aggregate Index and measures investment grade mortgage backed pass-through securities of GNMA, FNMA, and FHLMC.

- Bloomberg Barclay’s Global Aggregate Securitized- US Asset-Backed Securities, which is a component of the Bloomberg Barclay’s US Aggregate Index and includes the pass-throughs, bullets, and controlled amortization structures of only the senior class of ABS issues.

- The Blomberg Barclay’s US Floating Rate Notes (<5 Yr) Index, measures the performance of U.S dollar-dominated, investment grade floating rate notes with maturities less than 5 years.

- The Bloomberg Barclay’s Municipal Bond Index, which measures investment grade, tax-exempt bonds with a maturity of at least one year.

- The S&P/ LSTA Leveraged Loan Index is designed to reflect the performance of the largest facilities in the leveraged loan market.

Key Rates

Key Rates are shown for US Treasurys and London Interbank Offered Rate (LIBOR), the interest rate at which banks offer to lend funds (wholesale money) to one another in the international interbank market. LIBOR is a key benchmark rate that reflects how much it costs banks to borrow from each other. “Current” refers to the percentage rate as of 6/30/2018, while the rates of change are stated in basis points.

Credit Spreads

Credit Spreads shown comprise the Option-Adjusted Spread of the indices indicated, versus the US 10-Year Treasury Yield. “Current” refers to the spread as of 6/30/2018, while the rates of change are stated in basis points.

Key Indicators

Key Indicators correspond to various macro-economic and rate-related data points that we consider impactful to fixed income markets.

- 2s10s (bps)/ 10 Yr vs 2 Yr Treasury Spread, which measures the difference between yields on 10-Year Treasury Constant Maturity Securities and 2-Year Treasury Constant Maturity Securities.

- West Texas Intermediate, which is an oil benchmark and the underlying asset in the New York Mercantile Exchange’s oil futures contract.

- Core Consumer Price Index, which measures the consumer price index excluding food and energy prices. Shown as of the prior month-end.

- Breakeven Inflation: 5 Yr %/ bps, which uses a moving 30-day average of the 5-Year Treasury Constant Maturity Securities and 5-Year Treasury Inflation–Indexed Constant Maturity Securities to derive expected inflation.

- Breakeven Inflation: 10 Yr %/ bps, which uses a moving 30-day average of the 10-Year Treasury Constant Maturity Securities and 10-Year Treasury Inflation–Indexed Constant Maturity Securities to derive expected inflation.

General Disclosure

This document is intended for informational purposes only and should not be otherwise disseminated to other third parties. Past performance or results should not be taken as an indication or guarantee of future performance or results, and no representation or warranty, express or implied is made regarding future performance or results. This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security, future or other financial instrument or product. This material is proprietary and being provided on a confidential basis, and may not be reproduced, transferred or distributed in any form without prior written permission from WST. WST reserves the right at any time and without notice to change, amend, or cease publication of the information. The information contained herein includes information that has been obtained from third party sources and has not been independently verified. It is made available on an "as is" basis without warranty and does not represent the performance of any specific investment strategy.

Some of the information enclosed may represent opinions of WST and are subject to change from time to time and do not constitute a recommendation to purchase and sale any security nor to engage in any particular investment strategy. The information contained herein has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. Securities and services are not FDIC or any other government agency insured – Are not bank guaranteed – May lose Value.

Besides attributed information, this material is proprietary and may not be reproduced, transferred or distributed in any form without prior written permission from WST. WST reserves the right at any time and without notice to change, amend, or cease publication of the information. This material has been prepared solely for informative purposes. The information contained herein may include information that has been obtained from third party sources and has not been independently verified. It is made available on an “as is” basis without warranty. This document is intended for clients for informational purposes only and should not be otherwise disseminated to other third parties. Past performance or results should not be taken as an indication or guarantee of future performance or results, and no representation or warranty, express or implied is made regarding future performance or results. This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security, future or other financial instrument or product.