4Q 2022 | Markets & Economic Review

“Hope smiles from the threshold of the year to come, whispering 'it will be happier'...” -Alfred Lord Tennyson

"You don't find out who's been swimming naked until the tide goes out." - Warren Buffett

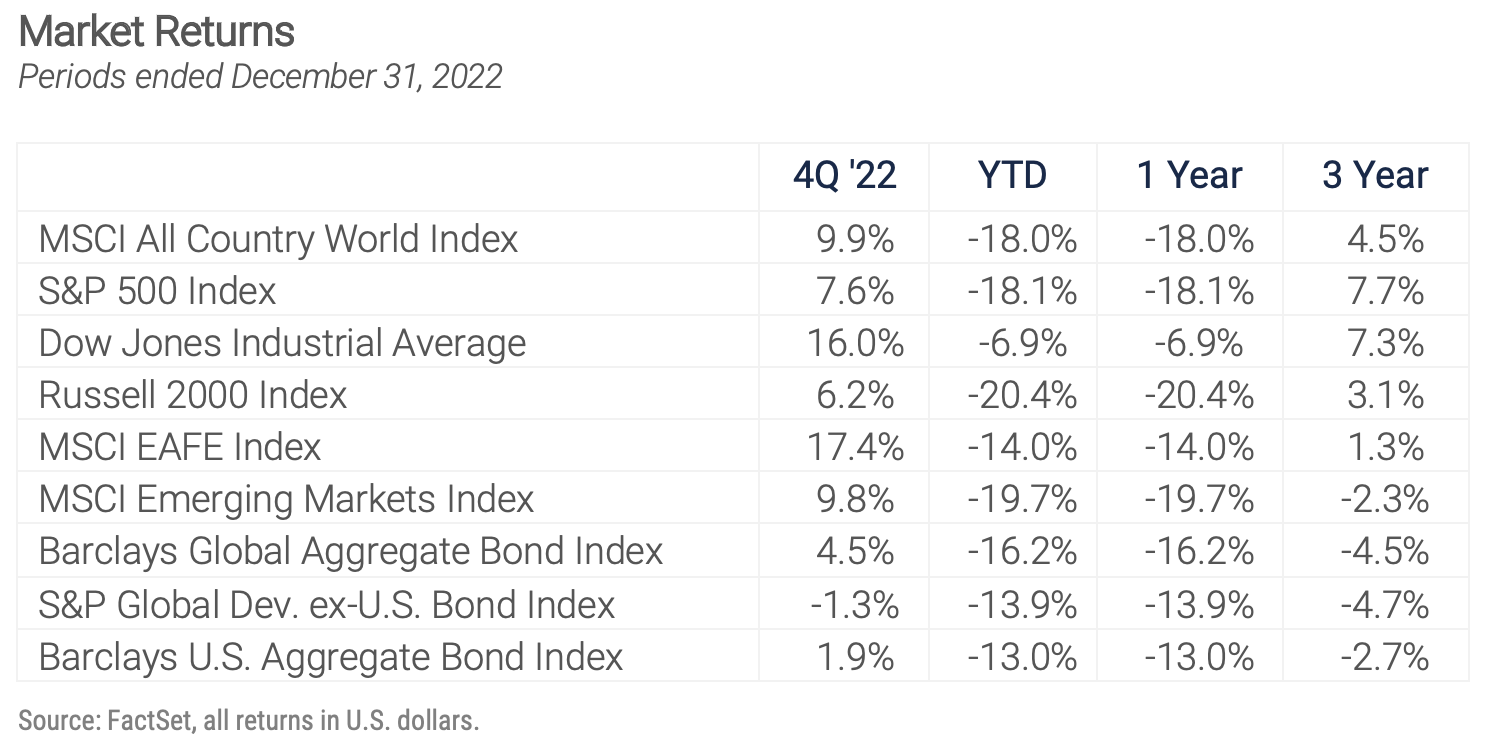

When the ball dropped in Times Square at midnight on December 31 it marked the end of the worst year for equity investors since the 2008 financial crisis and the worst year for bond investors in history.

As 2023 began we shared the sentiments felt by many: hopes for a new beginning and better times ahead tempered by concerns about the ongoing challenges facing the economy and markets. Despite a fourth quarter bounce off the early-October nadir in global equity prices, investors worldwide endured a collective decline of over $30 trillion in value in their stock and bond portfolios in 2022. Big U.S. technology stocks, the market leaders going into the pandemic and the most resilient in its immediate aftermath, were particularly hard-hit as repeated inflation surprises sent interest rates soaring. The FAANG stocks (Facebook, Amazon, Apple, Netflix, Google), the crème de la crème of the tech sector and overall market through the end of 2021, were down 46% on average in 2022. Those five stocks accounted for a large portion of the 33% decline in the NASDAQ Composite and the 19% decline in the S&P 500.

Bonds, normally a haven during times of tumult in the stock market, provided no protection. The Barclays U.S. Aggregate Bond Index, the broadest gauge of fixed income performance, declined 13% in 2022, and the U.S. Treasury Bond 30-year index fell 33.5%.

Many factors contributed to the performance of the economy and markets last year, but stubbornly high inflation and surprisingly swift increases in interest rates were the most important. Strong inflation and rising interest rates were analogous to the receding tide in Warren Buffett's quote at the opening of the letter, and the "naked swimmers" were individuals and institutions who’d built their financial and business models on what the Wall Street Journal called "the Federal Reserve’s detour into monetary illusion." The 15-year experiment with virtually free money begun by the Fed in 2008 has come to an end, and Modern Monetary Theory, which posited governments could borrow and print money indefinitely without impacting inflation and interest rates, has been debunked.

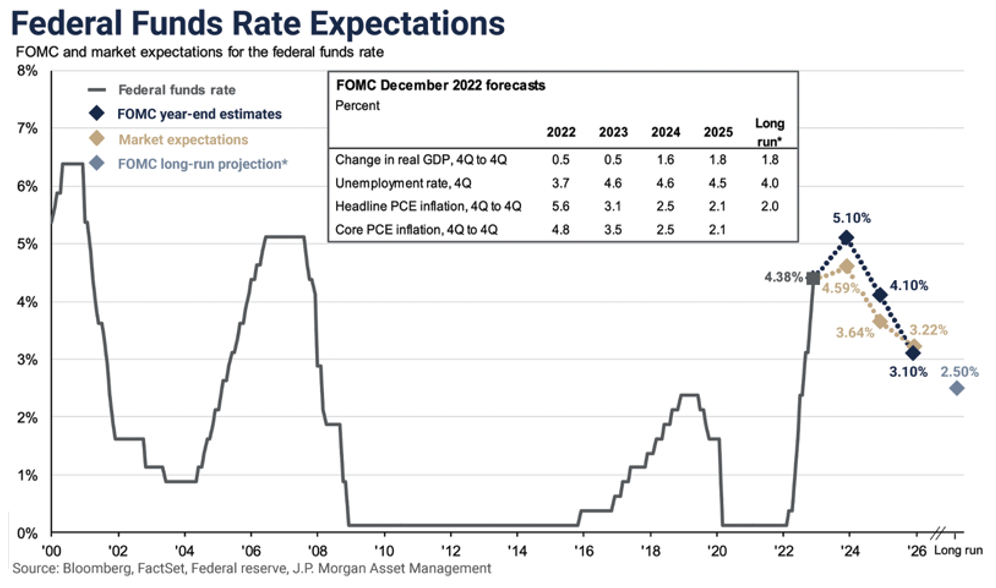

Most of the immediate "credit" for 2022's financial market debacle goes to the Fed policymakers who bet 2021's inflation would be "transitory." In hindsight the liquidity injected into the economy through rate policy and quantitative easing during COVID was effective in supporting demand during the shutdown but created imbalances in the form of inventory shortages and supply chain bottlenecks which proved hard to resolve as the broader economy recovered. The Fed arguably waited too long to withdraw the fuel from the economy, maintaining its zero interest rate policy from March 2020 until March 2022 even as unemployment declined and inflation rose. Since then, the Fed has embarked on the steepest rate hike cycle in its history, with seven increases in 10 months and a 4% increase in the Feds Fund rate target.

All commentators agree more rate increases lie ahead, and the important questions facing investors this year will again focus on the pace of coming rate hikes and the ultimate target level, both of which will be determined by the inflation picture. As the preceding chart reveals the market consensus as expressed by the Fed Funds futures is for the rate to peak at under 5% in the first half of 2023 followed by rate cuts in the second half of the year. However, most members of the Fed Open Market Committee (FOMC), the group that sets the Fed funds rate, believe they will need to continue raising rates through year-end with a terminal rate of 5.1% or higher expected in 2024. Fed Chairman Powell, in referring to the mistakes made by the Fed during the 1970s, when it vacillated between tighter and looser policy for years in an unsuccessful war against inflation, has warned "history cautions strongly against prematurely loosening policy." Given that backdrop we worry the Fed is regretful of its complacency in late 2021 and early 2022 and will compound the damage by tightening too much in 2023. As we were reminded last year market volatility spikes when expectations for inflation and Fed policy shift, so we foresee continued volatility this year as the gap between the FOMC guidance and market assumptions is resolved.

Economists are dubious about the Fed’s ability to titrate the correct mix of rate hikes and quantitative tightening to engineer an economic soft landing without causing a recession. An early January Wall Street Journal poll of strategists at 23 large financial institutions revealed two thirds believe the U.S. economy will enter a recession in 2023 and two others foresee a recession beginning in 2024. Factors cited include the damage already done in interest rate sensitive sectors like car sales and housing, where surging mortgage rates have curtailed home sales, plummeting CEO confidence, reduced capital spending, and rapidly depleting consumer savings.

With the Fed intent on mitigating the inflationary impact of the tight labor market, the economists surveyed expect the unemployment level to increase from November’s 3.7% to over 5% this year. That means millions of Americans will lose their jobs just as the $2.3 trillion of excess savings Americans had socked away at the height of the pandemic is exhausted.[1] Consumer spending comprises 70% of U.S. GDP, so the challenges facing consumers will be a key variable for the economy this year.

Finally, as we mentioned last quarter, new macroeconomic headwinds are complicating the Fed’s efforts. De-globalization, the unwinding of decades of increasing cooperation within the global economic and trade community, is inflationary because it shifts resources and production away from low-cost providers and forces the rebuilding of supply chains and manufacturing processes. Over the long term the resulting "onshoring" of production should be a net positive for the U.S., but in the short run the cost friction associated with those transitions is inflationary. Our tech-focused trade war with China and China's economic shift from export-led growth to a model driven by consumption and services are factors in the de-globalization trend, and the Russia/Ukraine war and its resulting impact on energy prices is another.

EQUITY MARKET OVERVIEW

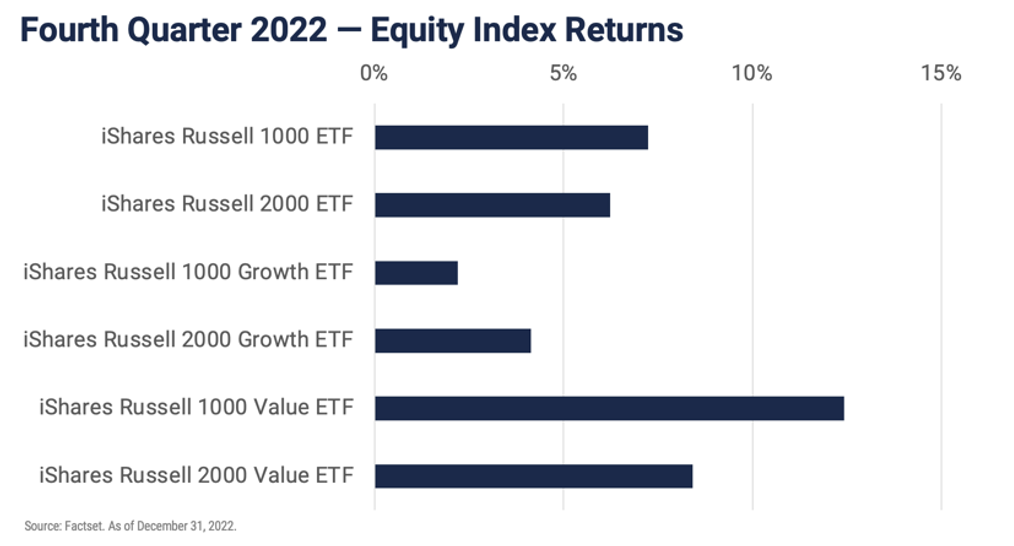

Starting with the good news: global equity markets rebounded strongly in the fourth quarter, and certain formerly unloved segments of the market performed particularly well. The S&P 500 rose 7.6%, while large-cap value stocks rose 12.4%, and non-U.S. equities as measured by the MSCI All Country World Index rose 9.9%. Those gains came as scant consolation considering the 19% calendar year decline for the S&P 500, but they reflect what we believe is our appropriate portfolio positioning and diversification as we look forward to the next market cycle.

Corporate earnings remain vulnerable to a recession in 2023, and many analysts believe current profit projections are too optimistic. Given the huge outperformance by the large-cap technology segment relative to small-cap and value stocks leading up to last year, the positive relative performance trend in both small and large cap value stocks may well continue in 2023, rewarding patient investors in diversified portfolios. At a minimum the lower valuations in those sectors should provide downside protection. Tech valuations are mixed at this point with many of the more speculative names still expensive, but the blue chip names in the sector including Alphabet (GOOG) and Microsoft (MSFT) are reasonably priced and primed to rally if interest rates decline.

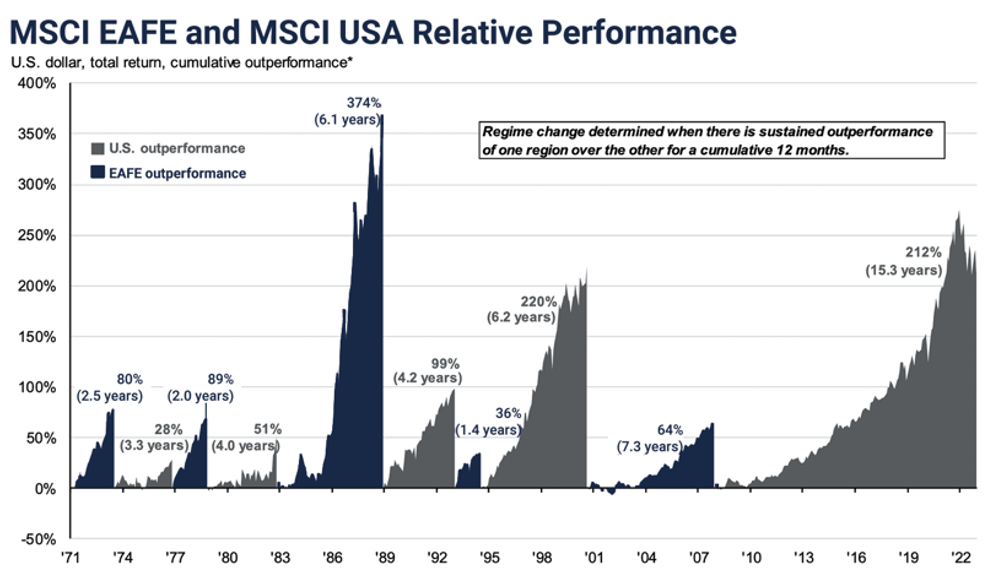

Geographic diversification is a cornerstone of our equity philosophy, and we remain convinced of the prudence of including an allocation to international equities in portfolios despite a long spell of underperformance versus their U.S. counterparts. As the graph below reveals the cycles of performance rotation between U.S. equities and their international counterparts are long and pronounced, and the last sustained period of outperformance by international stocks began in 2000 when the Internet bubble burst and lasted until 2008, when, not coincidentally, the Fed began its 15-year liquidity campaign.

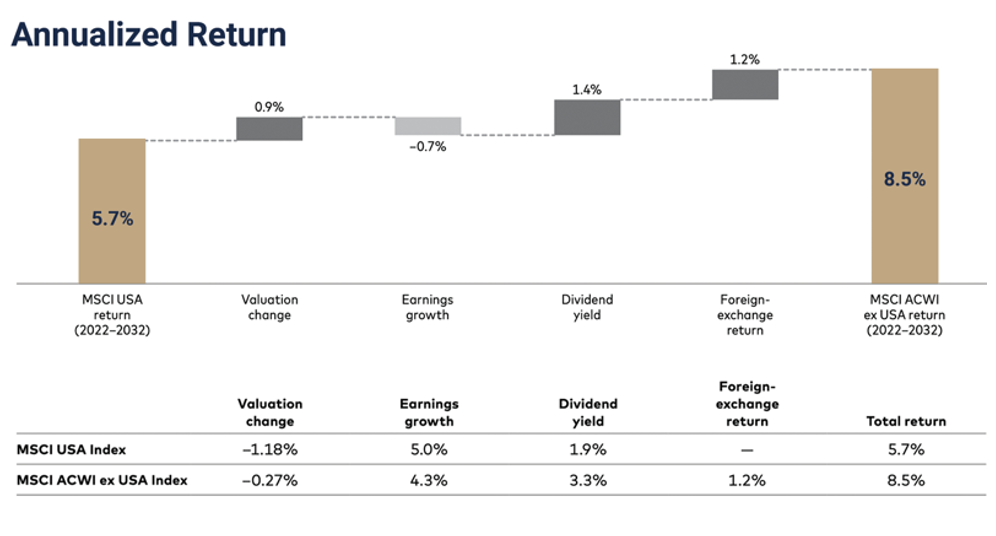

According to JPMorgan Asset Management's calculations at the end of December, international stocks as measured by the ACWI ex U.S. index trade at 12x forward earnings versus 17x earnings for the S&P 500 and yield 3.3% on average versus the S&P 500's 1.5% yield. Both gaps represent extreme discounts relative to historical metrics. Taking those discounts into account and recognizing the likelihood of a boost to international stocks from currency exchange rates as the dollar weakens after the Fed rate hike cycle ends, Vanguard makes a compelling case for global diversification over the next decade. All things considered Vanguard suggests international equities will generate returns, 2.5% to 3% higher than U.S. stocks over the next 10 years.

BOND MARKET OVERVIEW

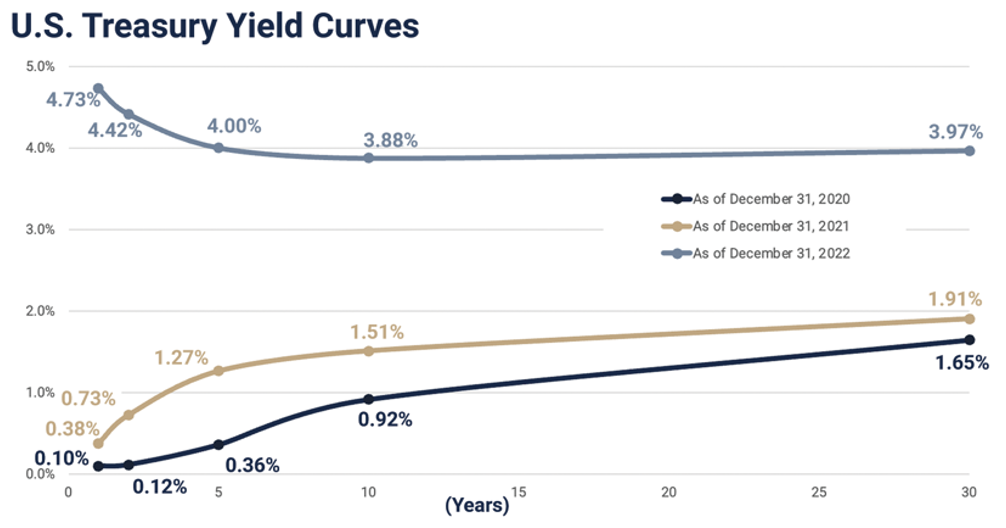

Bond yields were mostly unchanged during the fourth quarter, with short term rates declining a bit and longer term rates rising slightly. The damage done over the first nine months of the year is reflected in the final numbers for 2022, which as we mentioned include a 13% decline for the Barclays U.S. Aggregate Bond Index, and a 33.5% decline in the U.S. Treasury Bond 30-year index. The yield curve remains inverted, with short-term Treasury securities paying almost 5% while all maturities from five years through 30 years ended the year in the 4% range.

The term structure of interest rates depicted in the graph is important for two reasons. The first is the story it tells about the difference between the bond market’s expectations for economic growth and inflation and the Fed’s outlook. Bond investors demand a return that includes two components, a “real” return and a payment to offset inflation. For example, today’s 4% return on the 5-year Treasury implies a market expectation of inflation in the 2.0-2.5% range and a real return of 1.5-2.0% over 5 years. Investors only accept lower returns on longer-term bonds when they expect the interest rate on shorter-term bonds to decline, so the yield curve inversion reveals the current market expectation that the Fed will succeed in its efforts to quell inflation and will be able to cut rates in the relatively near future. That view is very different from the Fed’s stated outlook, which includes more rate hikes throughout 2023 and a terminal rate of 5.1%, a half percent higher than they projected as recently as September.

Clearly, the Fed sees inflation as more deep-rooted than the market does and Fed officials have expressed their clear intent to err on the side of over-tightening. In Chairman Powell’s words, “The worst pain would come from a failure to raise rates high enough and allowing inflation to become entrenched.” The minutes of the Fed’s December meeting, released in early January, reaffirmed their commitment to raise and hold interest rates higher to bring down inflation, even at the cost of a weaker labor market, and bluntly warned investors against underestimating their determination.

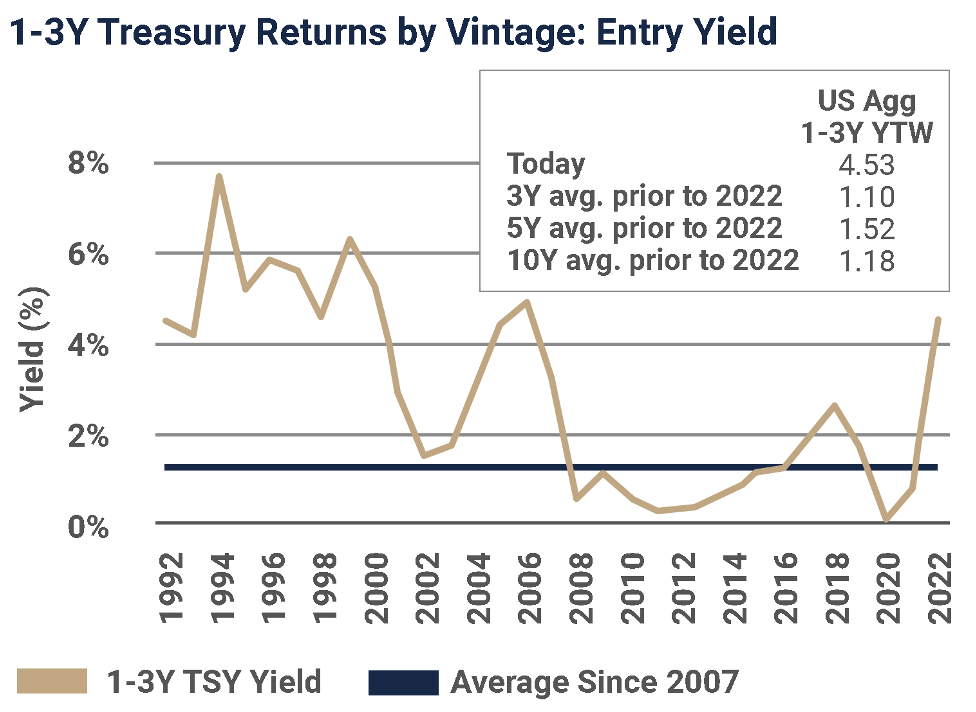

The second important takeaway from the current yield curve is the opportunity it presents for investors seeking income. For years the regime of Fed-induced low yields has left income investors starved for safe, stable cash flow. With short-term interest rates so high now investors don't need to move far out on the risk spectrum to achieve reasonable income. The current bond market allows us to buy short-term government and corporate bonds for income with very little duration risk. For example, as the following graph reveals, we are now able to buy portfolios of 1 to 3 year Treasury securities paying over 4 ½% where, for many years, that same portfolio yield was barely above 1%.

For just a little extra risk, we can add corporate bonds to portfolios increasing the yield another 1.0% to 1.5%. We’ll need to remain on watch for signs of credit deterioration in the corporate bond sector given the possibility of recession, but solid investment grade credits with strong balance sheets and diversified by industry are good additions to portfolios now. For taxable investors municipal bonds offer comparable opportunities. These short duration portfolios protected capital as interest rates rose last year and have provided us the flexibility to increase portfolio income. We expect similar dynamics in 2023.

SUMMARY

Pulling it all together we foresee another uneven year for the investment markets in 2023. Inflation and the Fed will remain in focus, and concerns about earnings growth and recession risk will add to volatility. Investor enthusiasm will be tempered as economic momentum slows, and the outlook for the market will depend upon how quickly investors look past the valley of the declining business cycle. It will not be a smooth trade-off between reduced inflationary pressures (good for bonds and stocks) and declining economic activity (good for bonds, bad for stocks.) Market activity in the short run will be unusually data dependent as investors scrutinize each economic report and digest every word out of the Fed.

The best news is the huge increase in short term interest rates, which has created attractive return opportunities in balanced and fixed income portfolios without requiring us to take on extra risk. Whether last year’s bloodletting in the stock market was sufficient to set up better returns this year will depend upon the course of the economy and earnings, but certainly valuations in many market segments are better now than they were a year ago.

Patient, long-term focused investors have endured and ultimately profited from prior cycles in the economy and markets, and this one should be no different.

Notes & Disclosures

Wilbanks, Smith & Thomas Asset Management (WST) is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation, or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. This material is not intended to replace the advice of a qualified tax advisor, attorney, or accountant. Consultation with the appropriate professional should be done before any financial commitments regarding the issues related to the situation are made.

This document is intended for informational purposes only and should not be otherwise disseminated to other third parties. Past performance or results should not be taken as an indication or guarantee of future performance or results, and no representation or warranty, express or implied is made regarding future performance or results. This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security, future or other financial instrument or product. This material is proprietary and being provided on a confidential basis, and may not be reproduced, transferred, or distributed in any form without prior written permission from WST. WST reserves the right at any time and without notice to change, amend, or cease publication of the information. The information contained herein includes information that has been obtained from third party sources and has not been independently verified. It is made available on an "as is" basis without warranty and does not represent the performance of any specific investment strategy.

Some of the information enclosed may represent opinions of WST and are subject to change from time to time and do not constitute a recommendation to purchase and sale any security nor to engage in any particular investment strategy. The information contained herein has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy.

[1] Dion Rabouin, “Big Banks Expect Recession and Fed Pivot” The Wall Street Journal, January 3, 2023

Besides attributed information, this material is proprietary and may not be reproduced, transferred or distributed in any form without prior written permission from WST. WST reserves the right at any time and without notice to change, amend, or cease publication of the information. This material has been prepared solely for informative purposes. The information contained herein may include information that has been obtained from third party sources and has not been independently verified. It is made available on an “as is” basis without warranty. This document is intended for clients for informational purposes only and should not be otherwise disseminated to other third parties. Past performance or results should not be taken as an indication or guarantee of future performance or results, and no representation or warranty, express or implied is made regarding future performance or results. This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security, future or other financial instrument or product.