U.S. Consumer Confidence Climbing Towards 18-Year High

There’s much ado in headlines around the latest release of the Consumer Confidence Index, which for August shows confidence at its highest since October 2000. The survey, established in 1967 and conducted monthly since 1977, is a widely watched barometer for the U.S. economy. Personal consumption expenditures represent nearly 70% of nominal Gross Domestic Product (GDP); and so, it stands to reason that the mindset of the American consumer is paramount to a healthy, growing economy, and the Consumer Confidence Index is believed to be a leading indicator of that mindset.

“Confidence is the feeling you have before you fully understand the situation.” - Unknown

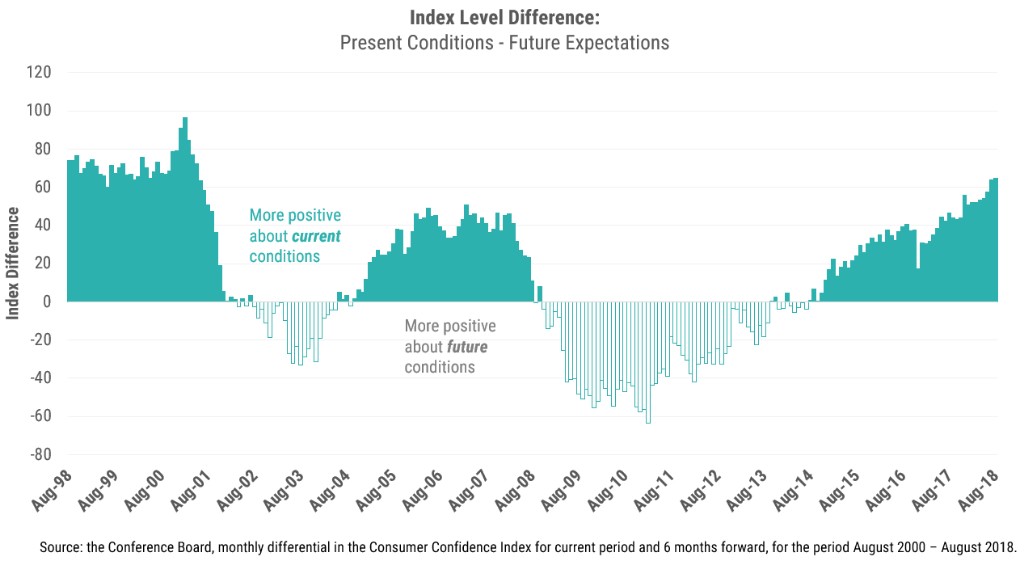

The survey consists of five questions, two of which focus on the present: current business conditions and employment conditions, while the remaining three questions focus on a six-month outlook for business conditions, employment conditions and family income. The history of the survey suggests expectations are, in fact, a more stable component of the overall survey than are answers to questions about present conditions.

Enthusiasm about current conditions has created an unprecedented gap in how we feel about the present versus the more immediate future. A partial explanation for this difference would be difficult to discern without a more thorough survey; however, the list of concerns clouding future expectations may be topped by the political risk currently dominating headlines regarding trade negotiations with our major partners. We believe that the longer and more contentious these negotiations, the greater the risk that confidence could slip from multi-year highs.

“Confidence is contagious. So is lack of confidence.” - Vince Lombardi

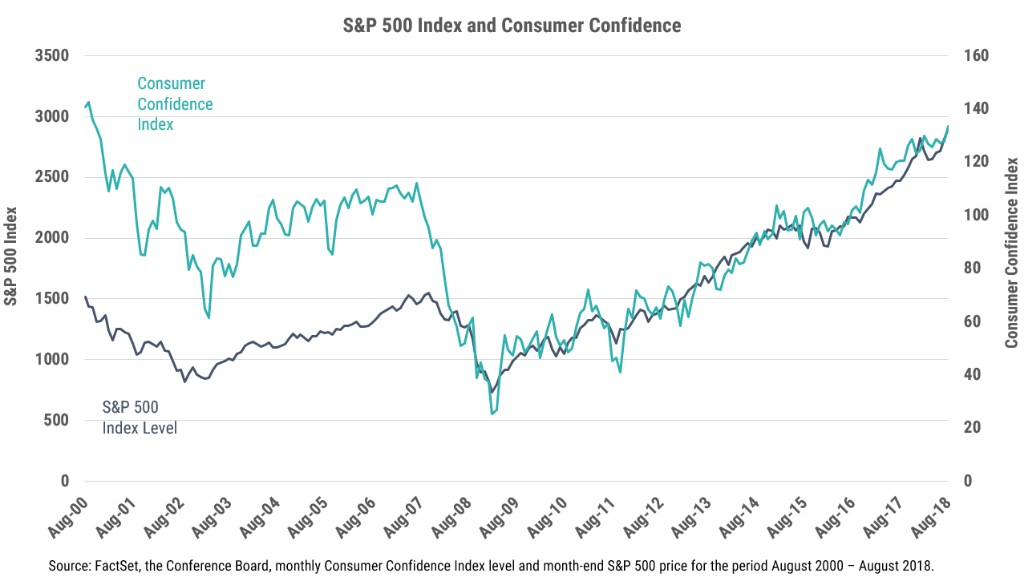

Vince Lombardi, the legendary, ever-quotable football coach, reminds us that confidence is emotive and fleeting. The chart below illustrates that the relationship between consumer confidence and stock prices is a strong one – the relationship feels sensible, given that the wealth effect from higher stock prices or real estate supports confidence in both our current and future situations.

It is, however, during these exuberant times - where confidence is brimming and stock prices are breaking records seemingly daily - that we must be most aware of our own susceptibility to a cognitive mistake that is particularly meaningful in markets and investing. Recency bias is evident when the most current trend is weighted most heavily and projected indefinitely in the future. This phenomenon seems to plays out again and again despite well-documented, evidence-based historical data warning against ignoring cycle risks in the economy and stock prices.

That said, contrarian thinking holds its own set of risks and should not be purely reflexive. Trends often last longer than expected and thoughtful objection to consensus view is essential to identifying important inflection points. Based on the current levels in both consumer confidence and stock prices, it may well be appropriate to become increasingly skeptical to further rises in both.

For more industry insights, visit the Wilbanks Smith & Thomas blog.

Besides attributed information, this material is proprietary and may not be reproduced, transferred or distributed in any form without prior written permission from WST. WST reserves the right at any time and without notice to change, amend, or cease publication of the information. This material has been prepared solely for informative purposes. The information contained herein may include information that has been obtained from third party sources and has not been independently verified. It is made available on an “as is” basis without warranty. This document is intended for clients for informational purposes only and should not be otherwise disseminated to other third parties. Past performance or results should not be taken as an indication or guarantee of future performance or results, and no representation or warranty, express or implied is made regarding future performance or results. This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security, future or other financial instrument or product.