March 2020: Fixed Income Market Review

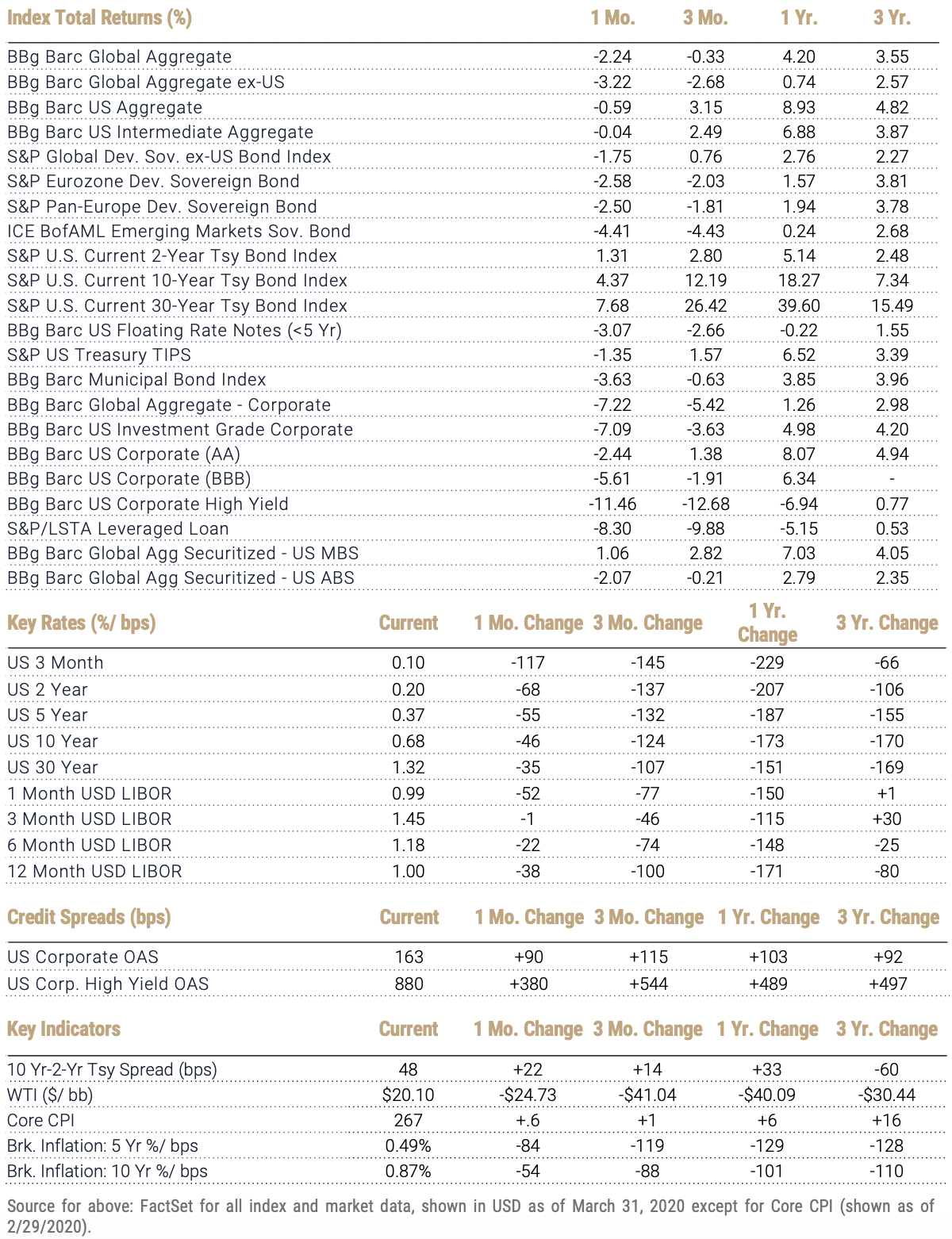

The month of March was a rollercoaster ride for fixed income as fears of the COVID-19 pandemic rippled through bond markets. Interest rate volatility approached levels not seen since the 2008 Financial Crisis as the ten-year US Treasury yield hit 0.54%, its lowest level on record. Long duration treasuries outperformed short-term treasuries while corporate credit underperformed. The Bloomberg Barclays US Aggregate finished the month down 0.59% while adding 3.15% over 1Q.

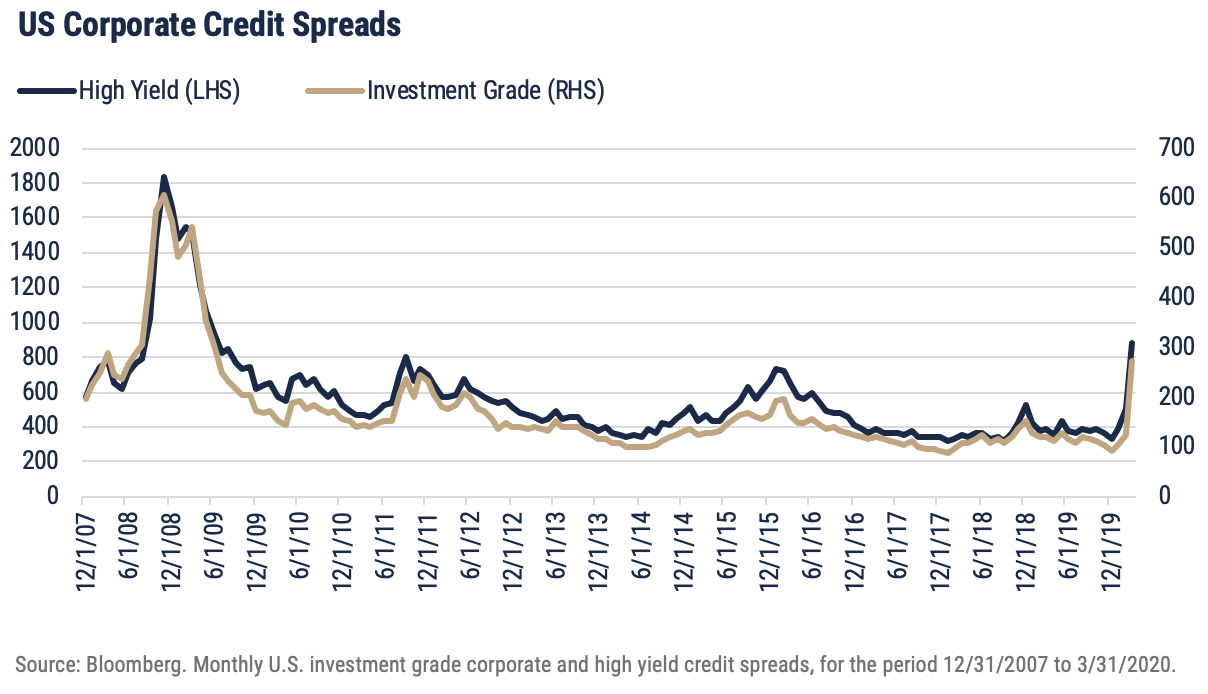

Corporate credit experienced its worst month in over a decade as concerns over the coronavirus and its effects on economic growth dramatically increased. Expectations for downgrades and defaults caused spreads on US investment grade corporates to rise by 150 bps, while high yield bonds saw spread widening of 380 bps. For the month, investment grade fixed income fell 7.1% while high yield declined 11.5%. Even short-term floating-rate corporate bonds, issued primarily from large financial institutions, saw spread widening in excess of 200 bps. In addition to the deteriorating outlook on credit, the lack of liquidity across the sector caused prices to fall further as investors raced to raise cash from highly rated issues. This imbalance finally led to the Federal Reserve stepping in while helping to stabilize the corporate credit market.

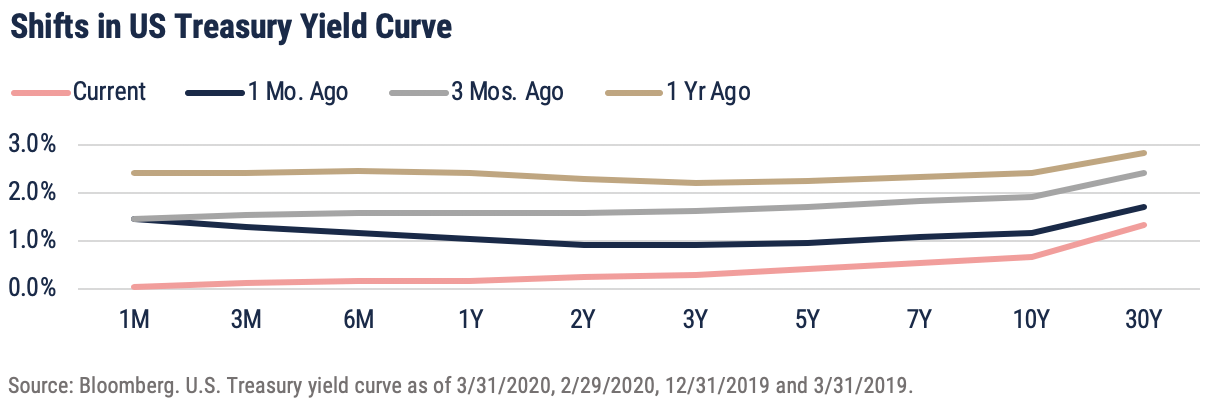

After lowering rates by 50 bps on March 3rd, the Federal Reserve cut rates again, this time by a full percentage point, on March 15th. As a result, the US yield curve steepened over 100 bps, as measured by the spread between the thirty-year and one-month yield. In addition to cutting rates, the Fed also announced they would purchase at least $500 billion and $200 billion of US Treasuries and Agency MBS, respectively.

Credit and liquidity facilities were also established to help alleviate stress within money, corporate and structured credit markets. The Primary Market Corporate Credit Facility (PMCCF) and the Secondary Market Corporate Credit Facility (SMCCF) were introduced to support credit issuance from investment grade corporate borrowers and provide liquidity for outstanding paper. The Money Market Liquidity Facility (MMLF) was instituted to assist money market funds in meeting redemptions. The Commercial Paper Funding Facility (CPFF) will purchase highly rated unsecured and asset-backed commercial paper from eligible companies and municipalities. The Term Asset-Backed Securities Loan Facility (TALF) will enable the issuance of ABS backed by student loans, auto loans and credit card loans. These unprecedented actions taken by the Fed helped to mitigate the shockwaves sent across the fixed income universe in recent weeks.

Important Disclosures

Index Returns – all shown in US dollars

All returns shown trailing 3/31/2020 for the period indicated. “YTD” refers to the total return as of prior-year end, while the other returns are annualized. 3-month and annualized returns are shown for:

- The Barclay’s US Aggregate Index, a broad based unmanaged bond index that is generally considered to be representative of the performance of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

- The ICE BofAML Emerging Markets Sovereign Bond Index is a subset of The BofA Merrill Lynch World Sovereign Bond Index excluding all securities with a country of risk that is a member of the FX G10, all Western European countries, and territories of the U.S. and Western European countries. The FX G10 includes all Euro members, the U.S., Japan, the U.K., Canada, Australia, New Zealand, Switzerland, Norway, and Sweden.

- The Bloomberg Barclays Global Aggregate Index, which measures global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

- The S&P Global Developed Sovereign Bond index includes local-currency denominated debt publicly issued by governments in their domestic markets.

- S&P Eurozone Developed Sovereign Bond - seeks to measure the performance of Eurozone government bonds.

- The S&P Pan-Europe Developed Sovereign Bond Index is a comprehensive, market-value-weighted index designed to track the performance of local currency-denominated securities publicly issued by Denmark, Norway, Sweden, Switzerland, the U.K. and developed countries in the Eurozone for their domestic markets.

- ICE BofAML Emerging Markets Sovereign Bond - tracks the performance of US dollar (USD) and Euro denominated emerging markets non-sovereign debt publicly issued within the major domestic and Eurobond markets.

- The Bloomberg Barclay’s US Corporate Bond Index (AA), which measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers.

- The Bloomberg Barclay’s US Corporate High Yield Index, which covers the USD-denominated, non-investment grade, fixed-rate, taxable corporate bond market.

- Bloomberg Barclay’s Global Aggregate Securitized- US Mortgage-Backed Securities, which is a component of the Bloomberg Barclay’s US Aggregate Index and measures investment grade mortgage backed pass-through securities of GNMA, FNMA, and FHLMC.

- Bloomberg Barclay’s Global Aggregate Securitized- US Asset-Backed Securities, which is a component of the Bloomberg Barclay’s US Aggregate Index and includes the pass-throughs, bullets, and controlled amortization structures of only the senior class of ABS issues.

- The Blomberg Barclay’s US Floating Rate Notes (<5 Yr) Index, measures the performance of U.S dollar-dominated, investment grade floating rate notes with maturities less than 5 years.

- The Bloomberg Barclay’s Municipal Bond Index, which measures investment grade, tax-exempt bonds with a maturity of at least one year.

- The S&P/ LSTA Leveraged Loan Index is designed to reflect the performance of the largest facilities in the leveraged loan market.

Key Rates

Key Rates are shown for US Treasurys and London Interbank Offered Rate (LIBOR), the interest rate at which banks offer to lend funds (wholesale money) to one another in the international interbank market. LIBOR is a key benchmark rate that reflects how much it costs banks to borrow from each other. “Current” refers to the percentage rate as of 6/30/2018, while the rates of change are stated in basis points.

Credit Spreads

Credit Spreads shown comprise the Option-Adjusted Spread of the indices indicated, versus the US 10-Year Treasury Yield. “Current” refers to the spread as of 6/30/2018, while the rates of change are stated in basis points.

Key Indicators

Key Indicators correspond to various macro-economic and rate-related data points that we consider impactful to fixed income markets.

- 2s10s (bps)/ 10 Yr vs 2 Yr Treasury Spread, which measures the difference between yields on 10-Year Treasury Constant Maturity Securities and 2-Year Treasury Constant Maturity Securities.

- West Texas Intermediate, which is an oil benchmark and the underlying asset in the New York Mercantile Exchange’s oil futures contract.

- Core Consumer Price Index, which measures the consumer price index excluding food and energy prices. Shown as of the prior month-end.

- Breakeven Inflation: 5 Yr %/ bps, which uses a moving 30-day average of the 5-Year Treasury Constant Maturity Securities and 5-Year Treasury Inflation–Indexed Constant Maturity Securities to derive expected inflation.

- Breakeven Inflation: 10 Yr %/ bps, which uses a moving 30-day average of the 10-Year Treasury Constant Maturity Securities and 10-Year Treasury Inflation–Indexed Constant Maturity Securities to derive expected inflation.

General Disclosure

This document is intended for informational purposes only and should not be otherwise disseminated to other third parties. Past performance or results should not be taken as an indication or guarantee of future performance or results, and no representation or warranty, express or implied is made regarding future performance or results. This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security, future or other financial instrument or product. This material is proprietary and being provided on a confidential basis, and may not be reproduced, transferred or distributed in any form without prior written permission from WST. WST reserves the right at any time and without notice to change, amend, or cease publication of the information. The information contained herein includes information that has been obtained from third party sources and has not been independently verified. It is made available on an "as is" basis without warranty and does not represent the performance of any specific investment strategy.

This material is proprietary and being provided on a confidential basis, and may not be reproduced, transferred or distributed in any form without prior written permission from WST. WST reserves the right at any time and without notice to change, amend, or cease publication of the information. Some of the information enclosed may represent opinions of WST and are subject to change from time to time and do not constitute a recommendation to purchase and sale any security nor to engage in any particular investment strategy. The information contained herein has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy. Past performance is not necessarily indicative of future results. Securities and services are not FDIC or any other government agency insured – Are not bank guaranteed – May lose Value.

Besides attributed information, this material is proprietary and may not be reproduced, transferred or distributed in any form without prior written permission from WST. WST reserves the right at any time and without notice to change, amend, or cease publication of the information. This material has been prepared solely for informative purposes. The information contained herein may include information that has been obtained from third party sources and has not been independently verified. It is made available on an “as is” basis without warranty. This document is intended for clients for informational purposes only and should not be otherwise disseminated to other third parties. Past performance or results should not be taken as an indication or guarantee of future performance or results, and no representation or warranty, express or implied is made regarding future performance or results. This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security, future or other financial instrument or product.