1Q 2022 | Quarterly Economic & Markets Review

“It was a lot more fun to be in your 20’s in the 70’s than it is to be in your 70’s in the 20’s!" -Randall Forsyth in Barron’s

“The natural condition is one of insurmountable obstacles on the road to imminent disaster. Strangely enough, it all turns out well.” -Philip Henslowe, Shakespeare in Love

We entered 2022 expecting stubbornly strong inflation, higher interest rates, and increased market volatility, and the first quarter delivered on all fronts. Just as the impact of the COVID Omicron variant was easing central banks turned hawkish in the face of the strongest inflation in over four decades, raising concerns that the long downtrend in interest rates has ended. Then, as the markets were digesting the inflation news and adjusting expectations about the Fed’s course, Russia invaded Ukraine. Setting aside momentarily the unimaginable human toll of the war its economic impact is widespread and unpredictable, and it complicates the many questions facing investors. Inflation, now running at over 7% in the U.S., remains the key variable, and the Ukraine crisis adds complexity to the already challenging short-term inflation outlook. Households are flush with cash from COVID-related monetary and fiscal stimulus, and with unemployment close to all-time lows wage pressures continue to grow. Rising prices for energy and other commodities are exacerbating the global supply chain challenges already building last year. Thinking longer-term the Russia/Ukraine conflict has reshaped the world's energy markets and dealt a huge setback to globalization, jeopardizing one of the pillars of global economic growth and efficiency in recent decades. We also foresee structurally higher government spending on national defense, rising housing costs as demand continues to bump against supply constraints, and “green-inflation” in the form of higher costs associated with the shift to sustainable energy sources. Altogether the Fed’s mission to engineer a soft landing for the U.S. economy got much more complicated over the course of the quarter, and the trajectory of financial markets grew more uncertain.

All things considered, it is remarkable that risk assets held up as well as they did last quarter. Volatility surged, with the S&P 500 at one point down 12.8% from its all-time high in January and the NASDAQ down 20.4%, but stocks recovered strongly in March with the S&P 500 bouncing back 8.6% and the NASDAQ recovering 13% prior to March 31. Economist Mohamed El-Erian suggests in the Financial Times the market's resiliency is based more upon “hope and faith that it all turns out well” than on fundamental factors, but we do see some positives undergirding equities.

First and foremost is the continued strength of the domestic economy. The same factors elevating inflation risks also provide protection against a severe downturn. The labor market is robust with an unemployment rate of just 3.8% and record levels of job openings. Consumer balance sheets reflect the savings built up during the pandemic and substantial gains in the stock and housing markets in recent years. Economists hope these factors provide enough buffer to avert a deep recession if we experience one at all.

A second factor supporting stocks is the lack of viable alternatives for cash-heavy investors. We’ve written in the past about the “TINA” trade (There Is No Alternative) and equities continue to provide the best long-term return potential despite higher interest rates and increased volatility. In fact, with inflation running at current levels the real return on cash and bonds (income yield minus inflation rate) is negative. Given this backdrop investors were quick to step in when stock declines reached double-digit percentages in January and February, revealing the “buy the dip” mentality that has worked so well during the long bull market.

It is difficult to predict what's ahead for the economy and markets in coming months while facing so much uncertainty about the next days and weeks. To a large extent, the fate of the economy depends upon the Fed’s ability to dampen inflation without extinguishing growth, a job made much more difficult by the uncertainty around the Ukraine situation. While the range of possible outcomes is wide, every scenario we construct includes more economic uncertainty and more market volatility than we’ve faced in recent years.

EQUITY MARKET OVERVIEW

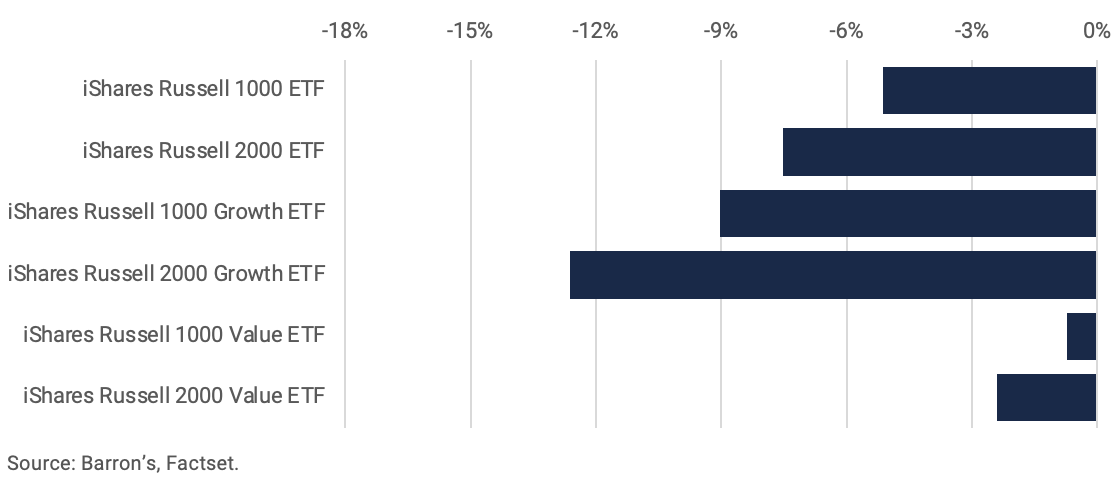

Global equities saw their biggest declines in two years in the first quarter, but rebounded in March despite increasingly troubling news out of Ukraine. U.S. equities, and particularly large-cap value stocks, generally held up best, and tech stocks continued to swing wildly as rising interest rates made long duration assets less attractive. Declines ranged from 4.6% for the S&P 500 to 9% for the NASDAQ Composite. Small cap stocks as measured by the Russell 2000 index declined 7.5%.

The value allocations in equity portfolios provided downside protection over the course of the quarter. Large cap value stocks dropped less than 1% versus the 9% decline for large cap growth stocks, and the discrepancy was even wider in the small cap arena where small cap value stocks fell 2.4% versus 12.6% for small cap growth companies. The relative strength in value stocks last quarter was driven by two primary factors.

First, as we discussed in previous letters, rising interest rates impact growth stocks more than value stocks. The fundamental value of any investment is the sum of its expected cash flows discounted back to the present. When interest rates are low the discount rate is low, so longer duration investments, those where most of the value will be realized in the more distant future, tend to perform better. When rates rise the present value of those more-distant cash flows declines, so shorter duration assets including value stocks, which tend to pay higher dividends, generally outperform. The second factor in the value/growth gap last quarter was the rise in commodity prices, particularly oil. Energy and other commodity companies tend to trade at lower multiples of earnings, revenue, and book value, and they benefit from rising inflation and commodity prices relative to growth stocks. Also, it's important to remember that growth stocks came into the year at record high valuations relative to value stocks, so there was room for a correction in that relationship. Whether the trend of value outperformance will continue is one of the long list of uncertainties, but we remain diversified by style and positioned to benefit if the trend continues.

While investor focus is rightly directed to the implications of the Ukraine crisis and the global political and economic response, it is worth remembering that the ultimate driver of stocks over the long term is corporate earnings. For now, at least, the earnings picture remains stable. Expected earnings per share growth in 2022 for companies in the MSCI All Country World Index remains in the 6% range, down only 1% since the Russian invasion. Citigroup estimates that S&P 500 earnings as a whole will grow 8.8% in 2022 versus 2021. Corporate profits at that level should provide some protection even as interest rates rise. The various market sectors have been impacted differently. Lower earnings estimates in inflation-sensitive sectors have been offset by rising expectations for energy companies and the consumer segment, where corporations are better able to pass along increases in raw material prices. Somewhat surprisingly the generally robust earnings growth expectations in place at the beginning of the year for Europe, the UK, and Japan also remain intact but are under scrutiny.

If anything the resilience of global earnings expectations underscores the heightened risk facing the markets now. Even as the general tone of the economic outlook remains positive the likelihood of recession is rising. The interconnected risks raised by the war in Ukraine, rising inflation, the shift in Fed policy, and other factors including resurgent COVID in China led economists surveyed by the Wall Street Journal in early April to estimate an approximately 1/3 chance of the U.S economy entering a recession in the next 12 months, up from just 18% in January and around 10% a year ago. Stagflation, the combination of high inflation and subdued economic growth, is a very difficult malady for policymakers to treat and an unhealthy environment for corporate profits and equity markets. Investors will be watching the data closely.

BOND MARKET OVERVIEW

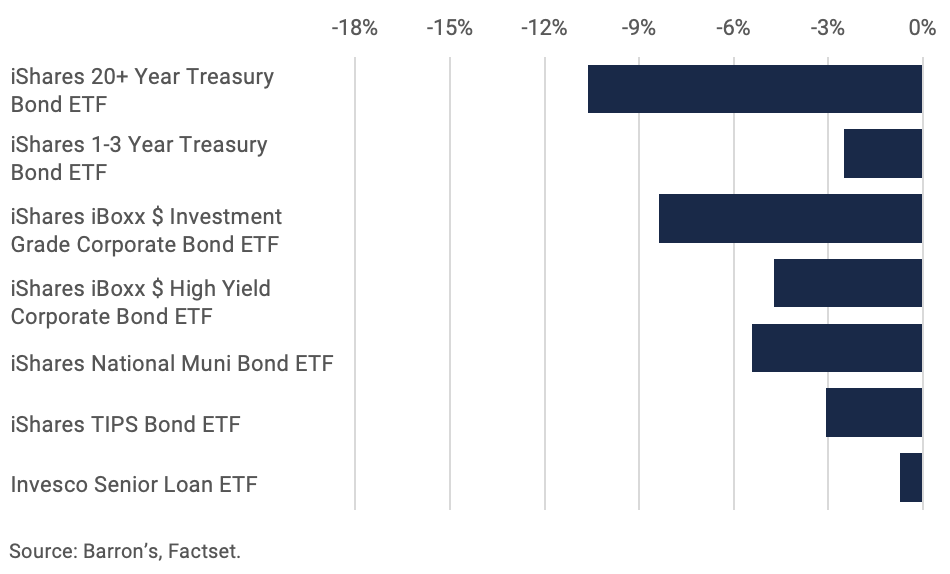

Steadily rising inflation and a growing acceptance of the inevitability of aggressive Fed action led to a rout in fixed income markets during the first quarter. Bonds, normally a safe haven in times of stock market volatility, declined more sharply than equities in response to the inflation data and concerns about the impact of the war in Ukraine on input prices.

The Barclays US Aggregate Bond Index, the most broadly referenced gauge of bond performance, declined 5.9% in the first three months of 2022, its worst performance since 1980. Long-term bonds fared even worse, with the iShares 20+ Year Bond ETF declining 10.6%. That punishing number comes on the heels of last year’s -4.6% return, meaning investors in long-term bonds have lost almost 10 years of income-based upon yields available on December 31, 2020.

By keeping our portfolio durations relatively short we avoided the worst of the losses and have cash available to reinvest as yields increase. We expect continued upward pressure on interest rates until inflation stabilizes and the markets fully price in the shift in Fed policy, which along with the rate hikes now underway will also include quantitative tightening as the Fed partially unwinds its massive balance sheet. The rapid repricing of bonds last quarter gives us an opportunity to shift our bond portfolio allocations slightly with an eye toward taking advantage of the higher rates available in the short end of the yield curve. For the time being the most attractive opportunities in fixed income remain in the sweet spot of 2 to 5 year bonds, the segment of the bond market most impacted by the changing expectations for inflation and Fed policy.

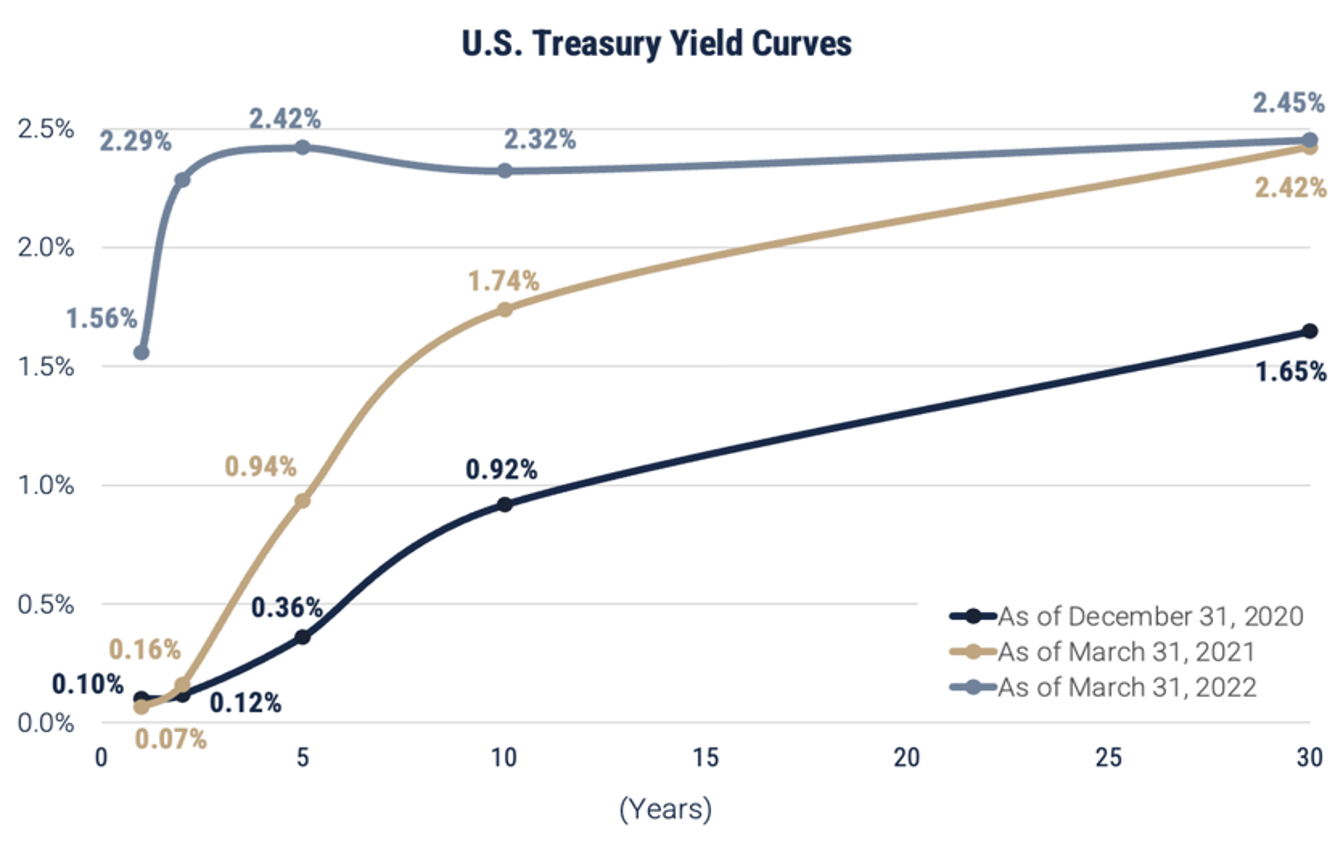

The graph below depicts the dramatic change in the term structure of interest rates over the past year. In March 2021 the Fed had short term rates anchored at zero and the shape of the yield curve implied market expectations of inflation remaining in the 2% range. Now, with inflation elevated, the Fed is on a path that could raise the policy rate target to at least 2.5% to 2.75% by year-end, up from 0% in January, and the next several months are pivotal to the longer-term outlook for the economy, bond market, and investment markets in general.

Note the shape of the yield curve in the 5 to 30 year range on the chart below. The flatness and partial inversion of that segment of the curve reflects the market’s belief that the Fed’s policy shift will contain inflation relatively soon, and reveals the heightened recession risk brought on by Fed’s stated determination. Obviously, if inflation continues to run in the 5% to 7% range the 10-year Treasury yield can’t stay in the 2% to 2½% range. Even if inflation stabilizes in the 3% to 3½% range, not unlikely given the supply/demand dynamics in many parts of the economy, yields could rise another 1% or more this year.

The implications of rising interest rates extend well-beyond the bond market. The 10-year Treasury bond yield is a benchmark and foundation for the pricing of financial assets and products across the spectrum including mortgage and other consumer loan rates, real estate cap rates, and equity valuations. Sustained higher yields, if we see them, will have a big impact on the path of the economy and the investment markets.

THINKING LONG TERM

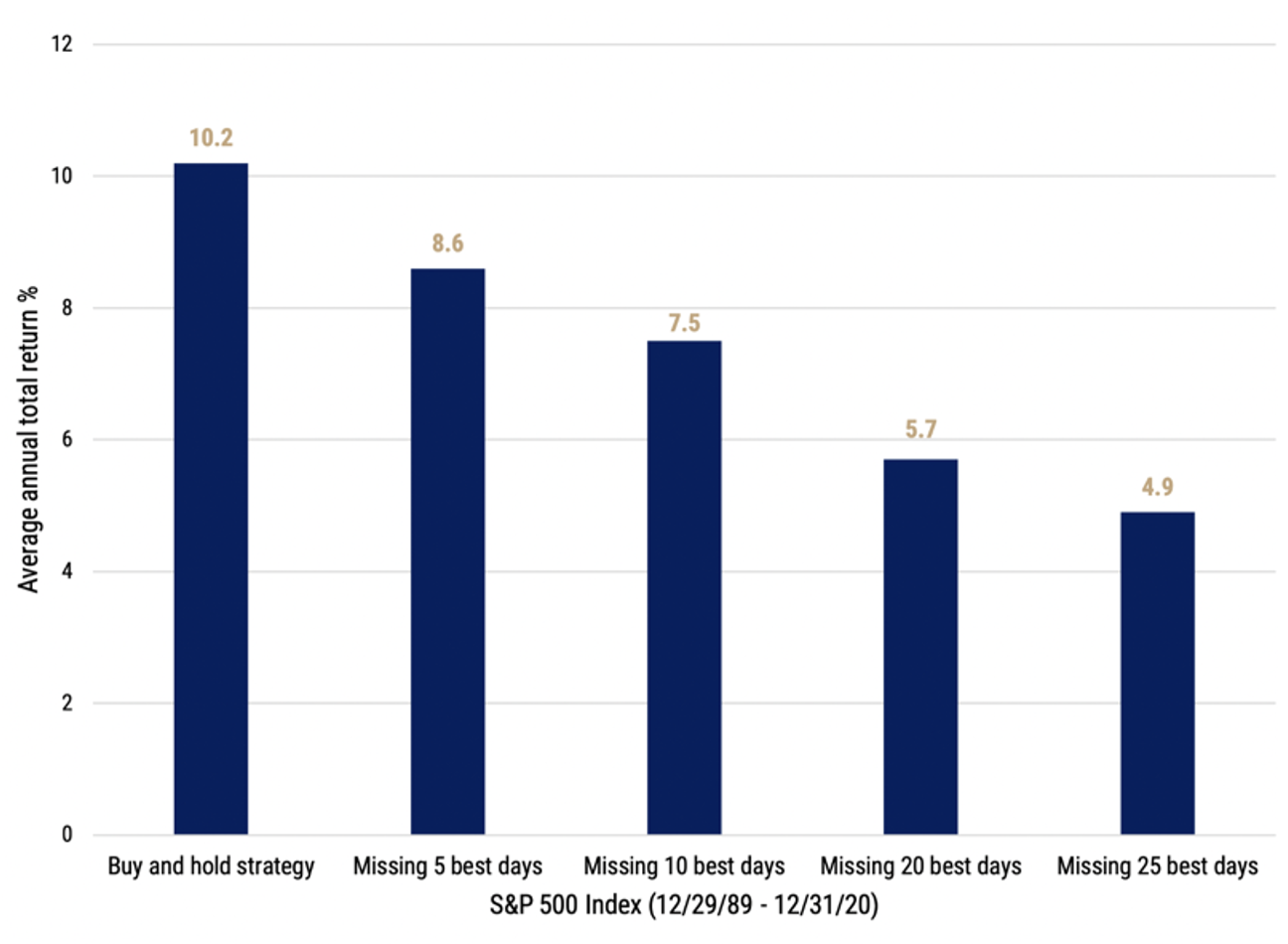

The surge in market volatility in the first quarter and some subsequent conversations with clients lead us back to the importance of thoughtful asset allocation and the value of long-term thinking in tumultuous times. The fear of losses makes a move to cash tempting as volatility rises, but portfolio reallocations driven by short-term market dynamics rarely pay off in the long term. The opportunity cost of being out of the market is too high. As we saw in March the recoveries after market declines tend to be rapid and strong. We reviewed the data from the 30 years ending December 31, 2020 and were reminded that missing just the 10 best days in the market during that 30 year period reduced an investor’s return from over 10% annualized to 7.5% annualized, meaning the investor who timed the market and missed those 10 days enjoyed a return 25% lower than the buy and hold investor. Missing just the 25 best days over 30 years cut the realized return by more than half! Even for quantitative, non-emotional investors, the prospect of picking highs and lows in the market is exceptionally difficult; adding in emotional reactions, greed and panic, makes market timing almost impossible.

POSITIONING & OUTLOOK

Looking out at the remainder of 2022 and beyond we see a wider range of possible scenarios for the economy and markets and therefore an increasingly risky environment for investors. The scenarios are challenging to handicap, but the best case would be a quick resolution of the Russia/Ukraine war, slower inflation which allows a more gradual tightening of monetary policy, and continued moderate economic growth. If the conflict is prolonged the global economy will face increasingly dire consequences of the financial sanctions imposed on Russia, most notably slower global economic growth with higher prices for energy and other commodities including wheat. That scenario could easily be worsened by a policy error if the Fed sticks to its guns in a determined effort to head off inflation even as the world falls into a recession. The Fed faces an unprecedented dual challenge as it begins to raise interest rates and attempts to shrink its balance sheet, a combination no central bank has faced in the past. This conundrum makes the global economic picture even more precarious because obviously the Fed is not positioned to bail the economy out in the event of a rapid downturn, as it has in every recent crisis including the Great Financial Crisis and the COVID pandemic. So for now the world economy is operating without the safety net of certain central bank support.

Important Notes & Disclosures

Wilbanks, Smith & Thomas Asset Management (WST) is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation, or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. This material is not intended to replace the advice of a qualified tax advisor, attorney, or accountant. Consultation with the appropriate professional should be done before any financial commitments regarding the issues related to the situation are made.

This document is intended for informational purposes only and should not be otherwise disseminated to other third parties. Past performance or results should not be taken as an indication or guarantee of future performance or results, and no representation or warranty, express or implied is made regarding future performance or results. This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security, future or other financial instrument or product. This material is proprietary and being provided on a confidential basis, and may not be reproduced, transferred, or distributed in any form without prior written permission from WST. WST reserves the right at any time and without notice to change, amend, or cease publication of the information. The information contained herein includes information that has been obtained from third party sources and has not been independently verified. It is made available on an "as is" basis without warranty and does not represent the performance of any specific investment strategy.

Some of the information enclosed may represent opinions of WST and are subject to change from time to time and do not constitute a recommendation to purchase and sale any security nor to engage in any particular investment strategy. The information contained herein has been obtained from sources believed to be reliable but cannot be guaranteed for accuracy.

Besides attributed information, this material is proprietary and may not be reproduced, transferred or distributed in any form without prior written permission from WST. WST reserves the right at any time and without notice to change, amend, or cease publication of the information. This material has been prepared solely for informative purposes. The information contained herein may include information that has been obtained from third party sources and has not been independently verified. It is made available on an “as is” basis without warranty. This document is intended for clients for informational purposes only and should not be otherwise disseminated to other third parties. Past performance or results should not be taken as an indication or guarantee of future performance or results, and no representation or warranty, express or implied is made regarding future performance or results. This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security, future or other financial instrument or product.