O Brother, Where Art Thou? Thoughts on Surging Stocks, the Fed and Hidden Treasure

An apt opener for discussion on today’s current market environment, this quote comes from the protagonist of the 2000 movie, O Brother, Where Art Thou? Set in the Deep South during the Great Depression, the film is a satirical riff on Homer’s epic Ulysses. In it, George Clooney’s memorable Everett is a charismatic, mostly well-meaning convict who is joined by two fellow convicts in a prison escape and apocryphal quest for treasure Everett claims to have buried before his imprisonment. Spoiler alert: the treasure doesn’t exist.

Judging by the trend in major stock market indexes since the election last November, the boost in confidence resulting from the outcome remains unshakeable. However, beneath the surface of record index levels breached in recent weeks by the Dow, S&P 500 and NASDAQ, some investors are starting to wonder if the treasure isn’t as fantastical as that chased by Everett and his fellow convicts.

Consider the fact the average stock in the S&P 1500 Composite Index is not at a record high, but is in fact on average 9.7% below the high over the past year. The bottom half of the 1500 companies that make up this index are on average down 19.7%, with the bottom quarter of the index (375 stocks) down on average more than 30% from its 52-week high.

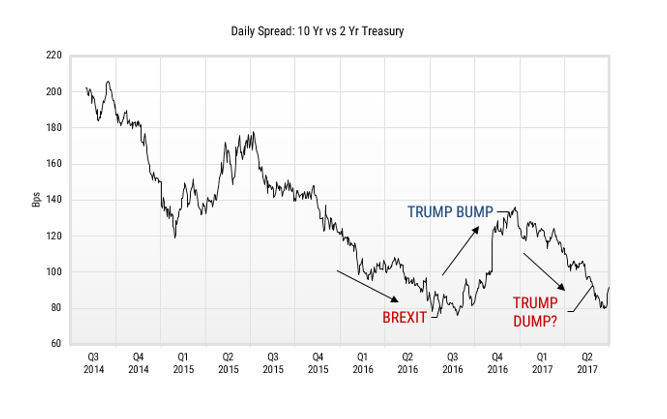

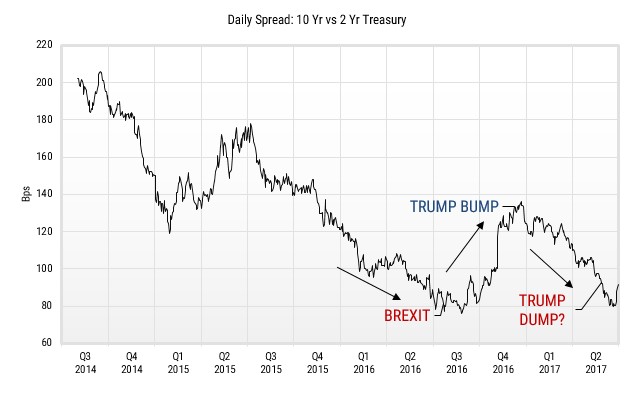

An analysis of market breadth (or lack) of participation by the average stock in the indexes can usually be argued from both sides. While narrow market leadership is often considered to be a sign of a market top, history suggests it is a flawed indicator with regard to both time and direction. A much more useful indicator is illustrated by the accompanying chart, which shows the difference in yield between a two- and ten-year Treasury note.

Source: FactSet, through 6/30/2017.

Source: FactSet, through 6/30/2017.

The Federal Reserve influences the short-term interest rates (defined as overnight out to two years) by their setting of the Federal Funds rate upon which all other short rates are typically based. The longer maturities are influenced most by expectations of inflation and the premium the market demands (defined as the real rate) for unforeseen events including forecast errors on inflation. When there is a wide difference between these two interest rates (i.e. a steep curve), liquidity tends to be ample and available for investment, and investors in long maturities demand a higher inflation premium built into the yield. When there is a narrow difference between these rates (i.e. a flat curve), liquidity is being constricted and inflation expectations of longer term investors demand a lower inflation premium. Significantly, bond investors expect economic activity and inflation will increase going forward in a steep yield curve environment while the opposite is true for a flat curve.

In its statement last week on its decision to raise the funds rate, the Federal Reserve noted:

“the Committee decided to raise the target range for the federal funds rate to 1 to 1-1/4 percent. The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a sustained return to 2 percent inflation.”

Despite the Fed’s decision and positive comments quoted above the bond market responded by ten year yields falling (i.e. prices rising). The spread between two and ten year yields is currently the tightest since Great Britain decided to exit the European Union last summer and well below the level which prevailed on our presidential election day (November 8th, 2016). In other words, the brighter economic outlook in the bond market as evidenced by the steeper curve in the weeks following the election has evaporated. Meanwhile, the stock market continues to hit numerous record highs since election day.

If we define treasure as continued economic growth, rising real estate prices, plentiful high quality jobs and sub 2% inflation, could it be that hidden treasure exists? Is the stock market like the smooth-talking Everett, convincing us our fortune is just around the corner? Or will we be like his hapless companions, Delmar and Pete, who eventually learn the truth about Everett’s fabricated story? The widening gap of expectations between stock and bond investors suggests that we may see the conclusion of this odyssey before too long.

Source for Treasury yield information: FactSet, through 6/30/2017. Besides attributed data, this material is proprietary and may not be reproduced, transferred or distributed in any form without prior written permission from WST. WST reserves the right at any time and without notice to change, amend, or cease publication of the information. This material has been prepared solely for informative purposes. The information contained herein includes information that has been obtained from third party sources and has not been independently verified. It is made available on an "as is" basis without warranty. This document is intended for clients for informational purposes only and should not be otherwise disseminated to other third parties. Past performance or results should not be taken as an indication or guarantee of future performance or results, and no representation or warranty, express or implied is made regarding future performance or results. This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security, future or other financial instrument or product. Some of the information enclosed may represent opinions of WST and are subject to change from time to time and do not constitute a recommendation to purchase and sale any security nor to engage in any particular investment strategy.

Besides attributed information, this material is proprietary and may not be reproduced, transferred or distributed in any form without prior written permission from WST. WST reserves the right at any time and without notice to change, amend, or cease publication of the information. This material has been prepared solely for informative purposes. The information contained herein may include information that has been obtained from third party sources and has not been independently verified. It is made available on an “as is” basis without warranty. This document is intended for clients for informational purposes only and should not be otherwise disseminated to other third parties. Past performance or results should not be taken as an indication or guarantee of future performance or results, and no representation or warranty, express or implied is made regarding future performance or results. This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any security, future or other financial instrument or product.